Brief Summary of the Article

Withholding tax (WHT) is one of the key elements of the tax system concerning cross-border payments for, among other things, interest, dividends, or licensing fees. Polish law lays down specific rules for settling this tax and outlines situations in which it does not have to be paid. In this article, we will cover:

- the legal basis regulating withholding tax in Poland,

- how WHT operates and the most important upcoming changes for 2025,

- the main exemptions and exclusions that relieve taxpayers from paying WHT,

- the significance of a foreign contractor’s certificate of tax residence,

- the “pay and refund” procedure,

- practical calculation examples in the form of a table, illustrating various scenarios and the impact of holding a tax residence certificate for a foreign contractor.

What Is Withholding Tax and Who Does It Apply To?

Withholding tax (WHT) is a form of taxation in which the entity making specific payments is responsible for collecting the tax at source. This mechanism is applied in cross-border transactions—i.e., when a Polish entity (a company, business owner, or individual entrepreneur) pays remuneration to a foreign contractor (a legal entity or individual who is not a Polish tax resident).

The most commonly encountered types of payments subject to WHT include:

- dividends,

- interest,

- licensing fees,

- remuneration for intangible services (e.g., consulting, accounting, research),

- payments for the use of or the right to use industrial equipment.

The obligation to withhold tax rests with the Polish paying entity, which should calculate, collect, and remit the due tax to the tax office when making a cross-border payment. The standard WHT rate in Poland varies depending on the type of income (e.g., 19% on dividends, 20% on certain services), and on whether there is a valid double tax treaty (DTT) between Poland and the recipient’s country of residence.

Legal Basis

Withholding tax in Poland is primarily governed by the following legal acts:

- The Corporate Income Tax Act of February 15, 1992, especially Articles 21 and 22.

- The Personal Income Tax Act of July 26, 1991.

- Implementing regulations issued by the Minister of Finance on detailed rules for WHT collection.

- Double Tax Treaties (DTTs) concluded by Poland with other countries.

Since 2019, Poland has introduced a range of changes aimed at improving and tightening the withholding tax collection system. One of the most important modifications was the introduction of the “pay and refund” mechanism, whereby the tax is first withheld and then—provided certain conditions are met—partially or fully refunded. More information on this you can find at Ministry of Finance website.

In the context of 2025, it is necessary to consider, among other things, the relevant amendments to the legislation and continued restrictions on the use of preferential rates under double tax treaties if the so-called “substance” conditions are not met; that is, the foreign contractor must conduct genuine economic activity and hold key documents (e.g., a residence certificate).

Key Changes and Mechanisms in 2025

As legislation and administrative practice evolve, the Ministry of Finance seeks to further tighten the tax system and improve reporting procedures. The following are among the most important mechanisms and changes to take into account in 2025:

- Strengthened verification of beneficial owners – Tax authorities pay increasing attention to whether the foreign payment recipient is truly the ultimate beneficiary of the income or merely an “intermediary.”

- Continuation of the “pay and refund” mechanism – A paying entity that makes a payment exceeding a specified threshold (PLN 2 million annually to a single entity) is generally required to withhold tax at the domestic rate. Only later can it request a refund, provided, among other things, that a valid residence certificate is held.

- Digitalization of documentation – The ongoing trend towards e-declarations and the possibility of filing refund applications electronically aims to speed up procedures.

- Changes in general and individual rulings – Tax authorities may issue new guidelines clarifying the conditions for exemptions and the application of DTTs.

In practice, the key requirement for applying preferential rates (or a full exemption) in 2025 remains holding a valid tax residence certificate of the foreign counterparty and confirming that the recipient is the ultimate beneficiary of the payment.

Conditions for Exemption from WHT

The fundamental principle is that withholding tax should be withheld at the standard rate. However, there are several situations and conditions under which WHT is not due or may be reduced (for instance, down to a rate specified in the relevant double tax treaty). The most important factors that allow for exemption or a reduced withholding tax rate include:

- Possession of a tax residence certificate from the foreign contractor,

- A relevant double tax treaty (DTT) concluded by Poland with the recipient’s country of residence,

- A tax exemption threshold – for certain types of payments or in cases where the total amount does not exceed a specified level, it is possible to utilize subject-matter exemptions or tax preferences.

Below, we discuss three essential issues related to the possibility of not withholding tax at source in 2025.

Possession of a Foreign Tax Residence Certificate

A tax residence certificate is an official document issued by the relevant tax authorities in the country where the recipient of the payment has its registered office or place of residence. The certificate should confirm that the entity is subject to unlimited tax liability in that country.

Polish law generally requires withholding tax at domestic rates (e.g., 20% or 19%) if a valid residence certificate is not provided. Only if a proper and up-to-date residence certificate is presented may one apply:

- the WHT rate provided for in the relevant double tax treaty (usually lower),

- a full exemption from WHT (in special cases).

In 2025, rules regarding residence certificates remain crucial. Legislators still require that the certificate be valid, up to date, and refer to the specific period in which payments are made. If there are doubts about the authenticity of the document or the actual residence of the contractor, the tax authorities may request additional explanations or refuse to grant the reduced rate.

Relevant Double Tax Treaty

Double tax treaties are international agreements between countries to prevent double taxation of certain categories of income. If Poland has signed a DTT with the foreign recipient’s country of residence, a reduced WHT rate (e.g., 5%, 10%, or 15% instead of the standard 20% or 19%) or even a full exemption at source may often apply.

However, in order to take advantage of treaty benefits, the Polish payer must have:

- a valid, up-to-date residence certificate,

- proof that the contractor is the beneficial owner of the payment,

- information on the type of income received (dividend, interest, intangible services, etc.).

Provided the Polish payer meets these requirements and follows the procedural rules, there is no obligation to withhold tax at source—or the tax may be withheld at a reduced rate.

Tax Exemption Threshold

Legislators have also introduced a threshold, below which the “pay and refund” mechanism does not apply. If the total amount of payments to a single foreign contractor in a given tax year does not exceed PLN 2 million, and the required formal conditions are met (particularly possession of the residence certificate), then the payer can generally avoid withholding tax or withhold it at a preferential rate under the DTT.

However, exceeding the annual PLN 2 million threshold triggers the obligation to use the “pay and refund” mechanism. The payer is then required to withhold tax at the domestic rate at the time of payment and may only subsequently request a refund.

The “Pay and Refund” Procedure

The “pay and refund” mechanism was introduced to combat abuses involving the use of overly reduced WHT rates and to make it easier for tax authorities to verify whether a transaction truly qualifies for preferences. Under this procedure:

- The Polish paying entity withholds WHT at the domestic rate (e.g., 20% on intangible services), even though a lower rate under a double tax treaty might normally be available.

- The payer or the foreign beneficiary of the payment submits a refund application for the withheld tax to the relevant tax authorities.

- After verifying documentation (including the residence certificate and materials confirming beneficial owner status), the tax authority decides whether to refund some or all of the WHT.

The crucial point is that for payments under PLN 2 million a year (to a single recipient), the payer can use a simplified procedure and does not have to collect WHT at the domestic rate if it holds the appropriate documents (including a valid tax residence certificate).

In 2025, this procedure remains in effect and constitutes one of the most significant features of Polish tax law in cross-border settlements. It is essential to document all transactions thoroughly and to meet all formal requirements in order to make use of the procedure.

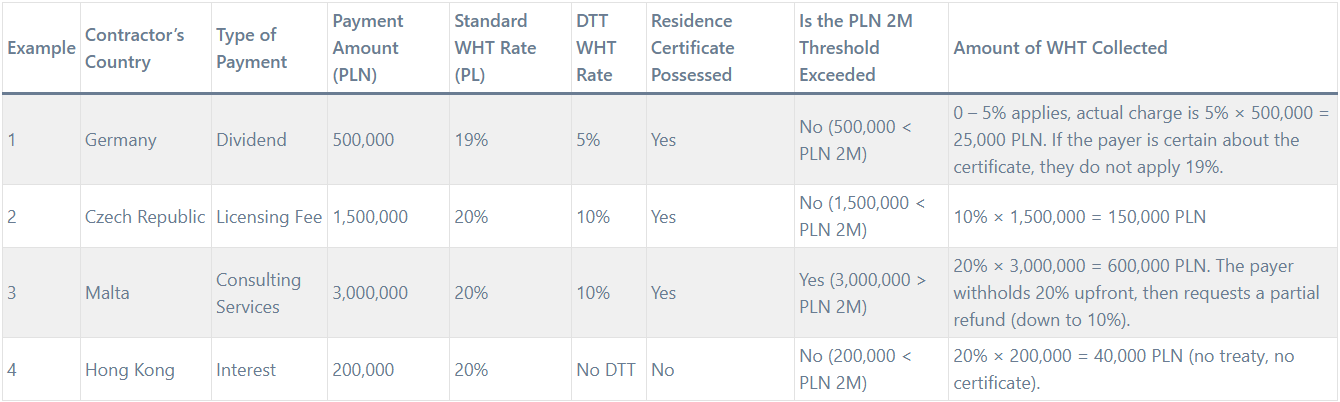

Sample Calculations – Table

The following table provides simplified examples of different scenarios for withholding tax settlements. The examples take into account:

- the type of payment (dividend, interest, licensing fee),

- the standard Polish WHT rate,

- the applicable rate under a double tax treaty,

- the impact of holding the contractor’s residence certificate,

- whether the PLN 2 million threshold is exceeded.

Discussion of the above cases:

- Germany – Dividend (PLN 500,000) Standard rate: 19%. The Poland–Germany DTT reduces WHT to 5% on dividends, provided that the recipient is the beneficial owner and the residence certificate is produced. The payer does not exceed the PLN 2 million threshold, so it does not have to use the “pay and refund” mechanism. In practice, only 5% (PLN 25,000) is withheld.

- Czech Republic – Licensing Fee (PLN 1,500,000) Standard rate: 20%. The Poland–Czech Republic DTT provides a 10% rate for licensing fees. Since the threshold of PLN 2 million is not exceeded and the certificate is valid, the payer withholds only 10% (PLN 150,000).

- Malta – Consulting Services (PLN 3,000,000) Standard rate: 20%. The Poland–Malta DTT typically provides for a reduced rate of around 10%, subject to a valid residence certificate and beneficial owner status. Exceeding the threshold of PLN 2 million triggers the “pay and refund” mechanism. The payer must initially collect 20% (PLN 600,000), then file for a partial refund to bring the effective WHT down to 10%.

- Hong Kong – Interest (PLN 200,000) Standard rate: 20%. There is no DTT between Poland and Hong Kong. No certificate of residence is provided, so no preferential rate can be applied. The payer withholds 20% (PLN 40,000). Even though the payment is under PLN 2 million, no special relief applies in the absence of both a DTT and a residence certificate.

Summary and Conclusions

Withholding tax will remain one of the most important areas of international settlements in 2025, and the relevant regulations continue to evolve, aiming for greater clarity and fewer loopholes. The main points to note are:

- Having a residence certificate is crucial. Generally, WHT must be withheld at the domestic rate unless a valid certificate is on file.

- Beneficial ownership – a key requirement is demonstrating that the payment recipient is the actual (beneficial) owner, rather than a mere intermediary.

- PLN 2 million threshold – crossing this threshold obligates the use of the “pay and refund” procedure.

- Detailed analysis of double tax treaties (DTTs) – each treaty may provide different rates or conditions for exemptions (e.g., beneficial owner clause, substance requirements).

- Up-to-date regulations and rulings – in 2025, monitoring current official interpretations by the tax authority and court rulings will remain essential to properly apply exemptions or reduced tax rates.

To avoid tax risks, it is vital to perform a thorough verification of each cross-border payment. In practice, this means:

- obtaining and keeping tax residence certificates (either physical or digital, if accepted by the authorities),

- checking the dates of validity and their correspondence to the payment periods,

- keeping documentation proving that the contractor is indeed the beneficial owner of the funds,

- fulfilling reporting and declaration obligations, including filing forms such as IFT-2R, CIT-10Z, PIT-8AR, etc., by the statutory deadlines.

Taking advantage of opportunities to avoid or reduce WHT in 2025 therefore largely depends on proper formal preparation, a thorough legal analysis, and constant monitoring of the regulations. Professional assistance may be provided by accounting offices and tax advisors who stay abreast of legislative changes.

Given the multitude of possible scenarios and countries in which the counterparty may be a tax resident, special attention should be paid to jurisdictions that do not have a double tax treaty with Poland or that, although they do have one, are considered preferential tax jurisdictions (“tax havens”) by Polish tax authorities.

In conclusion, not withholding tax at source or applying a preferential rate is possible only if all specific legal and formal requirements are met. Due to the increasing number of audits and the trend towards stricter regulations, one should meticulously document all international transactions. This is the best way to minimize the risk of having one’s accounting challenged by the tax authorities and to ensure correct application of WHT regulations in 2025.