Executive Summary

Effective April 1, 2024, the temporary 0% VAT rate on basic food products in Poland has been replaced by the standard 5% rate. This change applies to essential items such as meat, dairy, fruits, and vegetables, reflecting the stabilization of inflation trends. To ensure compliance, businesses must update their fiscal systems and invoicing software, noting that Binding Rate Information (WIS) decisions issued for the temporary zero rate are no longer valid.

As of 1 April 2024, Poland introduced significant food VAT changes, ending the temporary 0% VAT applied during the anti-inflation program. The new system restores the standard reduced VAT rate for basic groceries and redefines compliance obligations across the food supply chain. For businesses, the reform underscores the need for accurate classification, transparent pricing, and ongoing monitoring of legislative updates.

New VAT rates for food – what has changed?

For over two years, basic food items such as meat, dairy, eggs, vegetables, fruit, cereal products, and bread benefited from a 0% VAT rate. This measure was strictly temporary and linked to inflation control efforts. Since 1 April 2024, the VAT rate for these products has reverted to the standard 5% reduced VAT rate in Poland, which historically applied before the anti-inflation shield.

The revised new VAT rules for food products affect all goods listed in Annex 10 of the Polish VAT Act. This includes unprocessed and minimally processed food as well as certain products intended for infants and people on special diets. The shift from 0% to 5% VAT does not introduce new categories, but instead restores earlier tax mechanisms that were suspended due to extraordinary economic conditions.

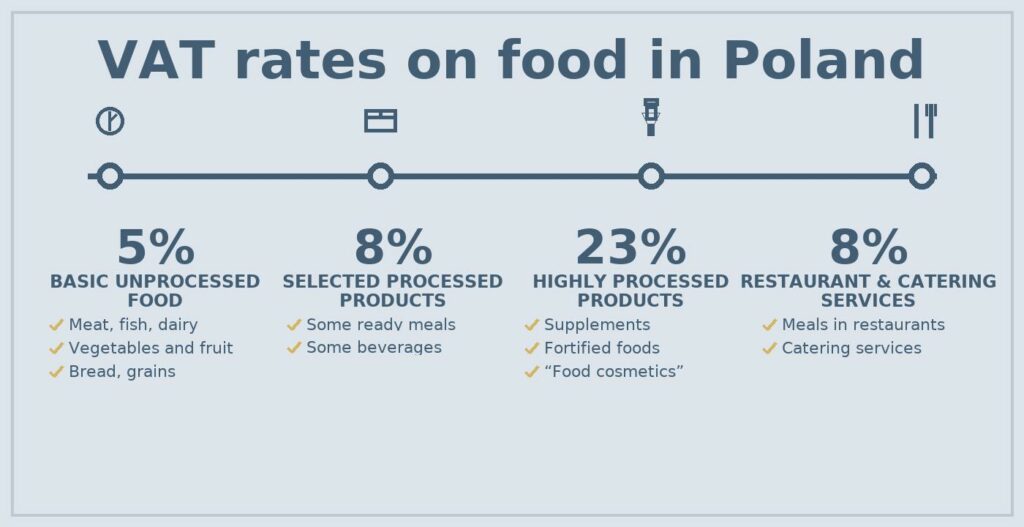

VAT Rates for Food Products in Poland

| Food Category | VAT Rate | Notes |

| Basic unprocessed food | 5% | Meat, fish, dairy, vegetables, fruits, bread, cereals |

| Selected processed foods | 8% | Certain prepared items, some beverages |

| Highly processed foods | 23% | Supplements, fortified foods, food cosmetics |

| Infant and diet-specific foods | 5% | Special dietary products listed in Annex 10 |

| Restaurant & catering services | 8% | Meals served in restaurants and catering |

| Imported food products | 5% / 8% / 23% | Rate depends on classification under PKWiU |

| Charitable food donations | Exempt | Subject to meeting statutory conditions |

Impact of changes on documentation

The return to the 5% rate triggered additional consequences for taxpayers, especially those who previously relied on Binding Rate Information (WIS) confirming eligibility for the 0% VAT. These WIS decisions lost validity as of the date of the rate change, meaning that businesses must:

- update their tax documentation and product classifications,

- adjust cash registers, POS systems, invoicing software, and ERP tools,

- review all food items whose VAT status depends on precise PKWiU classification,

- determine whether new WIS applications must be submitted to confirm the correct VAT category.

Because VAT rate adjustments in Poland can vary between 5%, 8%, and 23% depending on product complexity, correct categorization is now more important than ever. This is especially relevant for producers and importers of multi-ingredient items, functional foods, and borderline products.

Impact on food prices – market implications

The key question after the reform is how food VAT changes Poland will influence retail pricing. In theory, adding 5% VAT to products previously taxed at 0% may lead to price increases. In reality, several market factors soften this effect:

- strong competition between supermarket chains limits full price transfers,

- seasonal price fluctuations overshadow VAT changes in categories like fruit and vegetables,

- producers integrate VAT into price structures with gradual adjustments rather than immediate increases.

Nonetheless, the impact of VAT changes on consumers is noticeable, particularly among small retailers and local producers who have less ability to absorb increased tax burdens. Over time, the introduction of the 5% VAT rate may contribute to moderate price growth across key grocery categories.

VAT for retailers and producers – business obligations

Businesses must update sales systems, revise product databases, renegotiate contracts, inform trading partners, and apply for new WIS where necessary. The reform affects producers, wholesalers, and retailers differently, requiring internal adjustments across departments.

VAT categories in Poland – food-related rates

Although the central change concerns the return of the 5% rate, VAT categories in Poland for food remain structurally diversified:

- 5% VAT – basic food items (meat, fish, dairy, vegetables, fruit, bread, cereals).

- 8% VAT – certain processed foods, bottled water, selected beverages.

- 23% VAT – highly processed foods, dietary supplements, food cosmetics.

Certain situations may fall under VAT exemptions for food, including charitable donations of food to public benefit organizations.

Government VAT reform – broader context

These tax policy changes in Poland form part of the government’s long-term reform strategy aimed at stabilizing public finances while maintaining a fair and transparent VAT system. The re-established VAT rates are intended to:

- normalize tax collection after temporary relief measures,

- strengthen budget revenue,

- bring VAT rules for food products in Poland closer to EU-wide standards,

- reduce the administrative burden linked to temporary VAT exemptions.

For businesses, this means adjusting internal procedures to a more permanent and predictable tax environment.

How VAT changes affect consumers – summary

Consumers will gradually experience how VAT changes affect food prices, though the effect will vary by product type and market segment. For businesses, the reform underscores the need for accurate classification, transparent pricing, and ongoing monitoring of legislative updates. The return of the 5% VAT rate marks the end of temporary tax incentives and a re-alignment with Poland’s standard VAT framework for groceries and agricultural products.

Need further clarification or have any questions? Don’t hesitate to contact our Compliance Department. Email: office@intertax.pl