Executive Summary – when 0% VAT applies?

You may apply 0% VAT to an ICS from Poland when: (i) the goods are dispatched from Poland and reach another EU Member State; (ii) the buyer provides a valid EU VAT number; (iii) you are registered as VAT‑UE; and (iv) you hold evidence of transport (transport + commercial/electronic documents). The sale must be reported in VAT‑UE and your Polish JPK_V7.

For businesses engaged in selling goods to other EU member states, the Intra-Community Supply (ICS) framework offers the significant advantage of a 0% VAT rate. However, achieving this benefit is not automatic; it requires strict adherence to a complex set of legal, documentation, and reporting requirements. A single misstep can lead to the loss of this preferential treatment and significant tax liabilities. This guide provides a detailed, step-by-step breakdown of the entire process, from correctly defining the transaction to future-proofing compliance against upcoming regulatory changes in the digital age.

1. What is an Intra-Community Supply of Goods (ICS)?

Correctly identifying a transaction as an Intra-Community Supply of Goods (Wewnątrzwspólnotowa Dostawa Towarów, WDT) is the legal foundation for applying preferential tax treatment. This classification is a common source of costly errors, as misunderstanding its scope can invalidate a business’s claim to the 0% VAT rate from the outset.

1.1. The Legal Definition of ICS (WDT)

Under Article 13(1) of the Polish VAT Act, an Intra-Community Supply of Goods is defined as the export of goods from the territory of Poland to the territory of another EU member state, which occurs as a result of a supply of goods as defined in Art. 7 of the Act.

To qualify as a standard ICS transaction, both the supplier and the buyer must meet several essential conditions:

- The Supplier: Must be an active VAT taxpayer in Poland who does not benefit from a subjective tax exemption.

- The Buyer: Must be a VAT taxpayer identified for intra-community transactions in another member state (i.e., possessing an active EU VAT number) or a legal person who is not a VAT taxpayer but is identified for such transactions.

There are specific exceptions to the buyer’s status requirement. For example, a buyer does not need to be registered as a VAT-UE taxpayer if the transaction involves the supply of new means of transport or excisable goods being moved under a duty suspension procedure.

1.2. A Special Case: The Movement of Own Goods (Non-transactional ICS)

Polish VAT law also treats certain unilateral movements of a company’s own goods as an ICS, even when no sale occurs. As defined in Article 13(3) of the Polish VAT Act, this “non-transactional WDT” occurs when a business moves its own goods from Poland to another member state for its own business purposes.

Practical examples of this include:

- Moving semi-finished goods from a Polish warehouse to a company-owned factory in Germany to be used in production.

- Transferring finished products to a fulfillment warehouse in France to serve local customers, such as in the Amazon FBA model.

Despite the absence of a sale, this movement is treated as an ICS (WDT) for VAT purposes in Poland. This creates a corresponding obligation to report an Intra-Community Acquisition of Goods (WNT) in the destination country, often requiring the business to register for VAT in that member state.

Correctly identifying a transaction as an ICS is the first step, but securing the 0% VAT rate depends on meeting further stringent conditions.

2. Essential Conditions for Applying the 0% VAT Rate

The 0% VAT rate for an Intra-Community Supply is a conditional privilege, not an automatic right. Polish tax authorities meticulously scrutinize these transactions, and the burden of proof rests entirely on the Polish supplier to demonstrate that all legal requirements have been met.

2.1. Supplier and Buyer Status Requirements

The following non-negotiable status requirements must be met by both parties involved in the transaction:

- The supplier must be registered as a VAT-UE taxpayer in Poland before the date of the transaction.

- The buyer must possess a valid and active identification number for intra-community transactions (a VAT-UE number) issued by their own member state.

2.2. VIES Verification: Your First Line of Defense

Verifying the buyer’s VAT-UE number is a critical step of due diligence. This should be done using the official VIES (VAT Information Exchange System), a real-time EU database that confirms the validity of VAT numbers across member states.

- Official VIES Validation Portal: https://ec.europa.eu/taxation_customs/vies/

This check must be performed before issuing the invoice and shipping the goods. It is strongly advised to retain a printout or digital record (e.g., a PDF screenshot) of the successful VIES verification as part of the transaction’s documentation. During a tax audit, this record serves as crucial evidence that the supplier acted with due diligence to confirm the buyer’s status.

Once the counterparties’ statuses are confirmed, the next critical challenge is gathering the correct documentary evidence to prove the physical movement of goods.

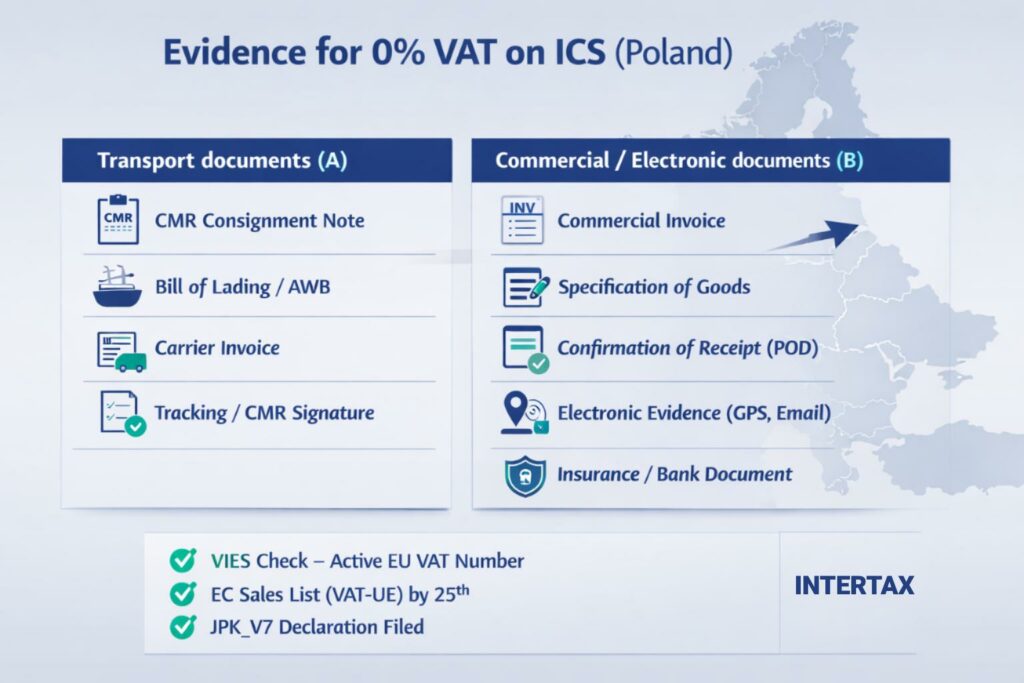

3. Proof of Transport: Assembling the Definitive Document Package

As advisors, we’ve observed a significant evolution in how Polish tax authorities approach documentation, shifting from a rigid insistence on original paper documents to a more modern acceptance of consistent and accurate electronic evidence. While the methods have evolved, the core requirement remains unchanged: the supplier must unequivocally prove that the goods left Poland and were delivered to the buyer in another EU country.

3.1. Primary Transport Documents

The basic and most widely accepted documents for proving transport vary depending on the mode of transport. These documents are considered optimal proof, especially when they contain signatures or stamps from the sender, carrier, and recipient.

3.2. Supporting and Electronic Evidence of Delivery

Under Article 42 of the Polish VAT Act, if the primary transport documents are insufficient on their own, the supplier must possess other evidence that collectively confirms delivery. Polish tax authorities are increasingly accepting technologically advanced proofs, provided they are consistent and accurate. Acceptable supporting evidence can be assembled into practical packages, such as:

- A specification of the individual units of cargo (specyfikacja poszczególnych sztuk ładunku).

- A signed confirmation of receipt from the buyer or an authorized party, which can be in the form of a separate statement, a scanned document, or a formal email.

- A combination of the invoice and a CMR note signed by the sender, carrier, and recipient.

- A combination of the invoice and a document from the buyer’s own logistics or accounting system confirming receipt of the goods.

- Electronic evidence from the carrier’s logistics or tracking system, such as “Proof of Delivery” printouts or confirmations from a shipment tracking tool.

- A combination of the invoice and a confirmation of payment for the goods, particularly if received after the confirmed delivery date.

3.3. Documentation Scenarios: Supplier vs. Buyer Arranging Transport

The responsibility for gathering documentation differs based on who organizes the transport.

- When the supplier arranges transport: The supplier’s responsibility is to collect the necessary transport documents (e.g., CMR note) from the carrier they hired, along with the specification of goods.

- When the buyer arranges transport (e.g., using Incoterms EXW): The supplier must be particularly diligent in obtaining proof from the buyer. The supplier should secure a document containing specific details, including the buyer’s information, the final delivery address, a description of the goods, a clear confirmation of receipt in the destination country, and details of the means of transport used.

Having the right documents is only half the battle; they must be correctly reflected in tax reporting at the right time.

4. Navigating Tax and Reporting Obligations

Mastering the procedural elements of ICS transactions is critical. Errors in timing, invoicing, or reporting can invalidate the 0% VAT rate, even if all substantive conditions, such as documentation, are met. This section details the key administrative obligations for Polish suppliers.

4.1. Determining the Tax Point for ICS

The tax point (moment powstania obowiązku podatkowego) determines the reporting period for the transaction. According to Article 20(1) of the Polish VAT Act, the rule is as follows:

The tax obligation for an ICS arises on the date the invoice is issued, but no later than the 15th day of the month following the month in which the goods were supplied (dispatched).

Example: If goods are dispatched to a contractor in Germany on November 30th and the invoice is issued on December 10th, the tax point occurs on December 10th. The ICS must therefore be reported in the declaration for December.

4.2. Invoicing Requirements for ICS Transactions

A compliant invoice for an ICS transaction must contain several specific elements in addition to standard invoice data:

- The Polish supplier’s VAT-UE number.

- The EU buyer’s valid VAT-UE number.

- The invoice must not include a Polish VAT rate or amount. A rate of 0% should be explicitly shown.

- A mandatory annotation such as “odwrotne obciążenie” or its English equivalent, “reverse charge”.

It is critical to note that Polish tax authorities require a formal VAT invoice even for non-transactional movements of own goods. Simply creating an internal accounting document is considered insufficient.

4.3. Reporting: The EC Sales List (VAT-UE) and JPK_V7

Polish suppliers are required to report all ICS transactions to the tax authorities through two primary channels:

- EC Sales List (Informacja Podsumowująca VAT-UE): This is a summary report of all intra-community transactions for a given period. It must be filed electronically by the 25th day of the month following the month in which the tax point arose. Failure to submit this report on time, or submitting it with incorrect data, is a direct cause for losing the right to apply the 0% VAT rate.

- JPK_V7: The details of the ICS transaction must also be included in the supplier’s monthly JPK_V7 declaration, which combines the VAT return and transactional data records.

4.4. A Related Obligation: Intrastat Reporting

Distinct from VAT reporting, the Intrastat system is a statistical reporting requirement for monitoring the physical flow of goods between EU countries. The obligation to file Intrastat declarations arises when a business exceeds annual turnover thresholds set by the Polish Central Statistical Office (GUS).

For 2025, the thresholds in Poland are:

- Arrivals (Przywóz): PLN 6,000,000

- Dispatches (Wywóz): PLN 2,800,000

Intrastat reports are due by the 10th day of the month following the reporting period. Tax authorities regularly cross-check Intrastat data with VAT-UE returns to identify discrepancies, making accuracy in both reports essential.

Mastering these procedures is key, but businesses must also be prepared for the severe consequences of failure.

5. Consequences of Missing Documentation and Non-Compliance

Failing to meet the strict compliance standards for Intra-Community Supply carries significant financial and legal risks. Tax authorities treat errors not as minor administrative slips but as fundamental failures that can nullify the transaction’s preferential tax treatment.

5.1. The Primary Consequence: Loss of the 0% VAT Rate

The most severe consequence of non-compliance is the loss of the right to the 0% VAT rate. If a supplier cannot provide the required documentation before the deadline to file the tax declaration for the relevant period, the transaction must be reclassified.

The direct financial impact is severe: the supplier must apply the standard domestic Polish VAT rate (currently 23%) to the transaction and remit this amount to the tax office from their own funds.

5.2. Other Penalties and Sanctions

In addition to losing the 0% VAT rate, businesses face several other potential penalties:

- Fiscal Penalties: In Poland, failing to issue a required VAT invoice is classified as a fiscal offense, punishable by a significant fine (grzywna). This penalty directly applies to the failure to issue a formal VAT invoice for non-transactional WDT, as discussed in the invoicing requirements section, highlighting that an internal document is not sufficient and carries legal risk.

- Intrastat Fines: Errors or missed filings for Intrastat can result in fines of up to PLN 3,000 per month for each direction of trade (arrivals and dispatches).

- Interest on Arrears: If VAT is assessed retroactively by the tax authorities, the supplier will also be liable for statutory interest on the tax arrears, which can accumulate rapidly.

The compliance landscape is continuously evolving, and businesses must prepare for future changes to avoid these risks.

6. The Future of ICS: The Impact of VIDA and KSeF

The world of VAT compliance is moving swiftly towards greater digitalization and real-time reporting to combat fraud and streamline administration. The EU’s “VAT in the Digital Age” (VIDA) package and Poland’s national e-invoicing system (Krajowy System e-Faktur, KSeF) are two key developments that will fundamentally change how intra-community transactions are documented and reported.

6.1. The “VAT in the Digital Age” (VIDA) Package

The VIDA package introduces a series of phased changes that will harmonize and digitize VAT reporting across the EU. Key changes relevant to ICS include:

- Mandatory Structured E-Invoicing: Starting from July 1, 2030, structured electronic invoicing that complies with the EU standard (EN16931) will become the standard for cross-border B2B supplies. This is a monumental shift for business processes, as unstructured formats like PDFs will no longer qualify as a valid invoice for these transactions.

- Real-Time Digital Reporting: This is a fundamental change from periodic, batched reporting to transactional, real-time data submission. The current monthly EC Sales List will no longer be required, as it will be completely replaced by a system of near real-time digital reporting of transaction data to tax authorities.

- Shortened Deadlines: The operational pressure on businesses will increase significantly. The deadline for issuing an e-invoice for an intra-community supply will be reduced to just 10 days from the date of supply, with the data being reported in real-time. For self-billing arrangements, the data must be reported within five days.

- Mandatory Reverse Charge: From July 1, 2028, a mandatory reverse charge mechanism will apply to B2B supplies by suppliers not established in the EU member state where VAT is due.

6.2. Poland’s National e-Invoicing System (KSeF)

Poland is ahead of the EU-wide mandate with its own national e-invoicing system, KSeF. Its implementation will significantly impact how Polish businesses handle international invoicing.

- Implementation Timeline: KSeF will become mandatory on February 1, 2026, for taxpayers with sales exceeding PLN 200 million for the 2024 fiscal year, and on April 1, 2026, for all other businesses.

- Scope: All sales invoices issued by Polish taxpayers to foreign counterparties will need to be processed through the KSeF system. In contrast, purchase invoices received from foreign suppliers will remain outside the system and should be processed traditionally.

Businesses should start preparing their IT, accounting, and logistics systems now to handle these new digital compliance demands and ensure a smooth transition.

Need help?

- Explore our VAT compliance services for drafting procedures and document templates.

- Read: Polish VAT Rules in 2025, VAT obligations and deadlines in Poland, and Intra‑Community Acquisition of Goods (WNT) in Poland for complementary rules.

- Contact our team for a file review before audit.