Executive Summary

Choosing the right legal structure is a critical first step for any foreign investor entering the Polish market. This article provides a strategic comparison between a Branch, a Polish Limited Liability Company (Sp. z o.o.), and a Representative Office, highlighting the trade-offs between tax efficiency and risk isolation. While a branch offers significant advantages in Withholding Tax (WHT) on profit repatriation, it leaves the parent company fully liable for Polish obligations. Conversely, a Sp. z o.o. provides a “corporate veil” to protect global assets but introduces more complex dividend taxation. Additionally, we examine the Representative Office as a low-compliance alternative, strictly limited to marketing and promotion. Readers will learn about the mandatory accounting rules, registration formalities in the National Court Register (KRS), and the practical necessity of a PESEL number for digital compliance in Poland.

From this article you will learn about the most important differences between a branch of a foreign entrepreneur and a Polish subsidiary. You will also learn when it is worth choosing a representative office instead of a branch in Poland.

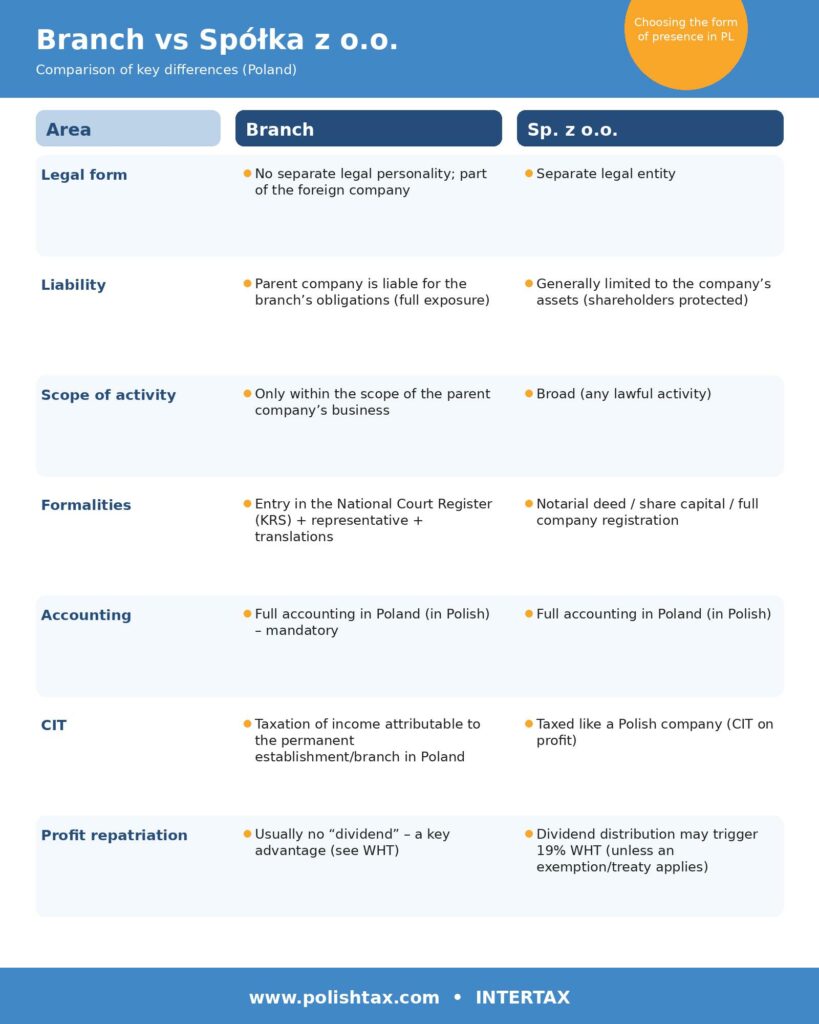

Branch vs Polish LLC (Sp. z o.o.) comparison

Choosing between a branch (oddział) and a Polish LLC (Sp. z o.o.) is usually a trade-off between tax efficiency on profit transfers and risk isolation. A branch has no legal personality (it is part of the foreign entrepreneur), while a Sp. z o.o. is a separate legal person.

Branch vs. LLC – Comparison Table

Withholding Tax (WHT) on profit repatriation

A major advantage of a branch is that profit transferred from the Polish branch to the foreign head office is usually not treated as a dividend – because a branch is not a separate legal person and the “payment” is typically an internal settlement within the same taxpayer. In practice, this often means no 19% dividend WHT that would commonly be relevant for distributions from a Sp. z o.o.

Important caveat: while “pure profit repatriation” is typically outside dividend WHT logic, WHT can still arise if the Polish operation makes separate outbound payments that fall into WHT categories (e.g., interest, royalties, certain intangible services) and are treated as paid from Poland.

Parent company liability risks

Because the branch is not an independent legal person, the foreign parent company is responsible for the branch’s obligations. This is the single biggest “red flag” and should be highlighted clearly – especially for higher-risk industries (construction, transport, product liability, regulated sectors). For many service models (IT, consulting, intra-group support), the risk profile may be acceptable, but the decision should be made consciously.

Registration in National Court Register (KRS)

A branch can operate in Poland only after registration in the National Court Register (KRS) and appointment of a representative. Typical requirements include: (1) corporate documents of the parent company, (2) a resolution to establish the branch and appoint a representative, (3) a Polish registered address, and (4) sworn translation of documents into Polish (often plus apostille/legalisation depending on the country of origin).

Practical note: translation and legalisation costs are frequently underestimated, but they can materially affect the “cheap setup” narrative versus a Sp. z o.o.

PESEL number for foreign directors

Although a PESEL number is not always strictly needed to register the entity, it often becomes critical for ongoing compliance, especially for electronic filings and linking an electronic signature to Polish systems. In particular, PESEL is commonly required in practice for submission of financial statements to the financial document repository. Without it, filings may require a proxy/attorney workflow.

Mandatory full accounting in Poland

A branch must keep separate accounting records in Polish, in line with Polish accounting rules, and submit required filings (including annual financial statements). This obligation exists even if the branch is not a separate legal entity.

If the branch hires employees in Poland, it must also handle payroll compliance (PIT advances, social security/ZUS obligations) under Polish law.

“Oddział w Polsce” naming rules

The branch name is not flexible branding: it must include the original name of the foreign entrepreneur, the Polish translation of the legal form, and the wording “oddział w Polsce”. This is a formal requirement and should be communicated early, because it impacts contracts, invoices, bank onboarding, and website/legal notices.

Corporate Income Tax (CIT) attribution

A branch typically aligns with the concept of a permanent establishment (PE) under double taxation treaties (DTT). Poland taxes profits only to the extent they are attributable to the PE/branch – i.e., as if the branch were a functionally separate enterprise performing its own functions and assuming its own risks.

This is where transfer pricing documentation and internal allocation policies matter: revenue attribution, cost allocations, management fees, and intercompany services should be structured and documented so that the Polish tax base is defensible.

Representative Office

A representative office is limited to promotion/marketing and is not meant to generate revenue. A branch can conduct business activity, but that also means tax/accounting obligations (CIT attribution, registrations, reporting). This distinction is important for investors who want a “soft landing” without triggering PE assumptions too early.

The choice between a representative office (representation) and a branch depends primarily on the purpose of the foreign company’s presence on the Polish market and whether this entity is to generate revenue.

Activities of the representative office limited to promotion and advertising

A representative office is a very limited form in terms of operation. It is worth choosing them if the only goal of the company in Poland is:

- conducting promotional activities,

- conducting marketing activities for a foreign brand.

- No intention to generate revenue: This is a key functional difference. While a branch office can run a full business and generate profits, a representative office is not designed to generate revenue. If a company plans to sell products or services directly through a Polish entity, it must opt for a branch or limited liability company. This means that it cannot sell goods or services on behalf of a foreign company on the Polish market. The branch, on the other hand, functions as an operating unit that generates profit subject to tax in Poland.

- Prohibition of conducting business activity: The most important limitation of a representative office is that its activity must be limited only to the promotion and advertising of a foreign entrepreneur.

- Functional limitations: Due to the inability to conduct business, the office cannot enter into commercial contracts, which is a natural function of the branch. The Branch, despite the lack of a separate legal personality, operates in trade as a full market participant.

Summary

While a branch office is a tool for active business in Poland (which entails CIT obligations and full accounting), a representative office is only a marketing tool that does not allow for real sales expansion. A subsidiary (limited liability company/sp. z o.o.) is a separate legal entity established under Polish law and may operate without any restrictions as an independent entity.