Executive Summary

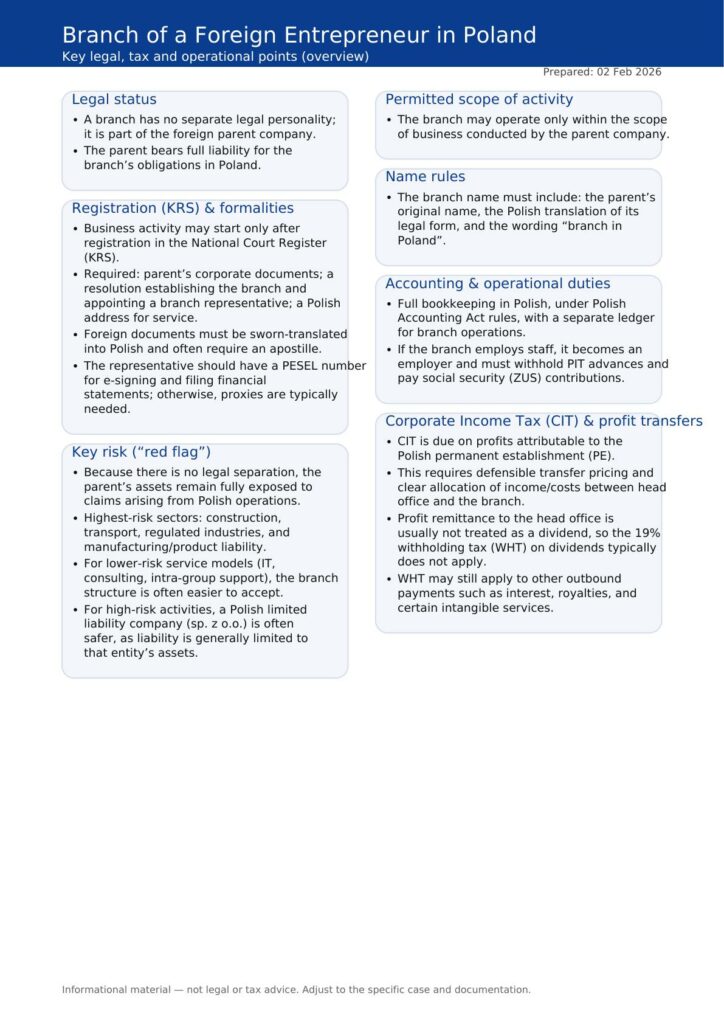

This article provides a comprehensive guide to establishing and operating a branch of a foreign entrepreneur in Poland. Key highlights include the legal nature of a branch—which lacks a separate legal personality, thereby placing full liability on the parent company—and the mandatory registration requirements in the National Court Register (KRS). Readers will gain insights into the specific naming conventions, the necessity of a PESEL-equipped representative, and the tax implications regarding CIT and profit transfers. The analysis further identifies high-risk industries where this model may be a “red flag” and offers a strategic comparison to alternative business structures, such as a limited liability company.

From this article you will learn basic information about the functioning of a branch of a foreign entrepreneur in Poland.

Branch (Branch of a foreign entrepreneur): It does not have its own legal personality and is treated as part of a foreign entrepreneur. This means that the foreign parent company is fully responsible for all liabilities incurred by the branch.

Scope of activities: A branch may only conduct business to the extent that the parent company conducts it.

Name: The name of the branch is strictly defined – it must contain the original name of the foreign entrepreneur, a translation of its legal form and the note “branch in Poland”

Registration and formalities: The branch requires the appointment of a representative, a Polish address, and the submission of corporate documents to the headquarters along with sworn translations. The representative should have a PESEL number. It is necessary for electronic signing and submission of financial statements to the repository of financial documents. Without it, this process requires the involvement of attorneys.

A branch can start operating in Poland only after obtaining an entry in the National Court Register (KRS).

Required documentation: The following are required for registration:

- corporate documents of the parent company;

- a resolution on the establishment of a branch and the appointment of its representative;

- indicating the Polish address for service.

All foreign documents must have a sworn translation into Polish, and often also an apostille clause.

Naming rules: The name of the branch is not arbitrary – it must contain the original name of the foreign company, a Polish translation of its legal form and the obligatory note “branch in Poland”.

Risks associated with the Branch:

The most important risk associated with a branch is the lack of legal independence from the parent company, because the branch does not have legal personality and is an integral part of a foreign entrepreneur. Therefore, the foreign parent company is fully responsible for all liabilities incurred by the branch.

This is considered the biggest threat (“red flag”), especially in industries with a high risk profile.

Industries where this business model is associated with the greatest risk:

- Construction: Due to the large scale of contracts, the risk of delays, accidents on the construction site and claims by subcontractors.

- Transport: This sector is associated with the risk of road accidents, liability for the goods transported and specific international regulations.

- Regulated sectors: Industries subject to strict state supervision, where violations can result in high administrative penalties imposed directly on the entrepreneur.

- Production (product liability): Wherever a defective product can lead to massive damages claims, which in the case of a branch directly hit the assets of the headquarters.

In these areas, the lack of legal separation means that the foreign parent company bears full exposure for all liabilities of the branch, and its assets are not protected from claims by creditors in Poland. In the case of service models such as IT, consulting or intra-group support, the risk profile is usually much lower and may be easier for a foreign investor to accept. Nevertheless, in industries with a high risk profile, a safer alternative is usually a limited liability company, in which liability is generally limited to the assets of that particular entity, which protects the shareholders’ capital.

Accounting and operational responsibilities

The branch must keep full accounting in Polish in accordance with the Polish accounting regulations. Therefore, the branch must keep separate accounting records for its operations. In the case of employing employees, the branch becomes an employer and must meet the obligations of a payer of social security contributions and PIT advances in connection with the payment of salaries.

Corporate Income Tax (CIT)

The branch pays CIT on income that can be attributed to its operations in Poland, in accordance with the concept of a foreign establishment (PE – Permanent Establishment). This requires precise documentation of transfer pricing and cost allocation between headquarters and branch.

The transfer of profit from the Polish branch to the headquarters is usually not treated as a dividend, as it takes place within the same entity, which means no 19% withholding tax (WHT). Keeping transfer pricing documentation is crucial.

The branch, although it offers tax benefits when transferring profits, exposes all the assets of the foreign company to claims arising as a result of operating in Poland

Transfer pricing and allocation of revenues and costs. Having internal policies for allocating revenues and costs (e.g. management costs, fees for intra-group services) is necessary for the amount of the tax base in Poland to be defendable against the tax authorities.

Withholding tax (WHT) exceptions. Although the transfer of “net profit” is WHT-free, this tax may still occur if the Polish branch makes other payments abroad that qualify for the WHT category, such as:

- interest,

- royalties,

- certain intangible services.

To sum up, this process is usually more tax-efficient than in the case of a limited liability company., but requires a rigorous approach to documenting how profits are attributed to Polish operations.

Summary

Q&A

Q: How does the process of CIT taxation and the transfer of profits from the Polish branch to abroad work?

A: The process of taxation and transfer of profits from the Polish branch to the foreign headquarters is based on the specific legal status of this entity, which does not have a separate legal personality, but is part of a foreign entrepreneur. Poland taxes the profits of a branch only to the extent that they can be attributed to the activities of that branch. In this respect, the principle of functional independence applies. It means that the income of a branch should be determined as if it were a functionally separate enterprise that performs its own functions and bears its own risk.