In brief

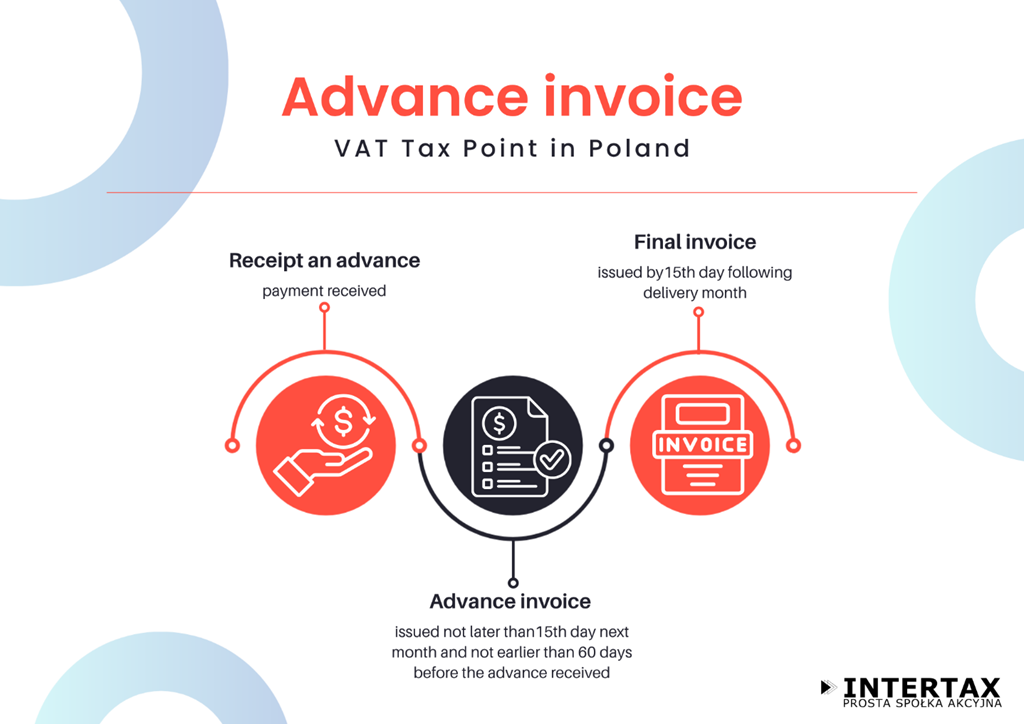

Under Polish VAT law, an advance payment for goods or services usually triggers the VAT tax point when the payment is received. The supplier must issue an advance invoice and settle VAT on the amount of the advance payment. There are statutory timing rules: invoices may not be issued earlier than 60 days before the supply or receipt of payment and must be issued no later than the 15th day of the month following the month of receipt. Key exceptions apply, notably to intra‑Community supplies of goods (ICS/WDT), where an advance does not create a VAT tax point. This article covers VAT rules only, not accounting treatment.

What is an advance payment and an advance invoice?

An advance payment is a portion of the payment made before a taxable supply is performed. Under Article 106b(1)(4) of the Polish VAT Act, the supplier issues an invoice documenting receipt of all or part of the payment prior to supply (commonly called an advance invoice). The advance invoice must show the amount of the advance payment, applicable VAT rate, and VAT due; and it must include specific elements listed in Article 106f(1) of Poland’s VAT Act (e.g., buyer/seller data, amount received, VAT amount). When a final invoice is later issued, it must refer to and settle the earlier advances, including KSeF identifiers where applicable (Art. 106f).

When does the tax obligation arise?

The basic rule in Article 19a(1) is that VAT becomes due when goods are delivered or services performed. However, Article 19a(8) provides that if the supplier receives all or part of the payment before supply (e.g., advance payment, deposit, prepayment, instalment), the tax obligation arises at the time of receipt of that payment to the extent of the payment.

VAT tax point for an advance invoice

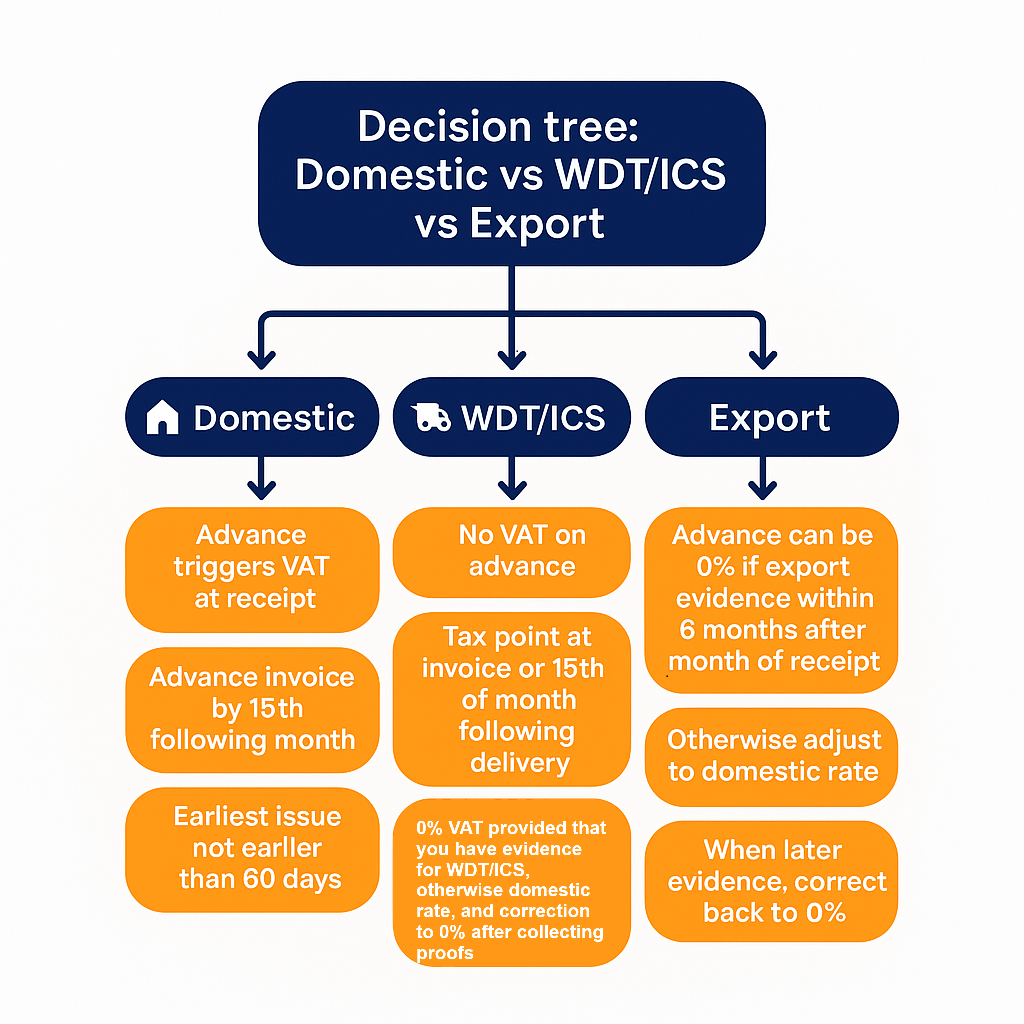

- Domestic supplies of goods and services: tax obligation on receipt of the advance. The supplier must include the advance payment in VAT for the period when the payment is received and issue an advance invoice within the statutory deadline (see below).

- Intra‑Community supply of goods (ICS/WDT): an advance does not trigger the tax point. For UCS/WDT, the obligation arises when the invoice is issued, but no later than the 15th day of the month following the month of the cross‑border delivery. Article 20 governs this, so a prepayment for ICS/WDT does not create VAT due at receipt of the payment.

- Export of goods: receipt of an advance triggers the tax point under the general rule, with settlement under the 0% rate subject to meeting conditions for export documentation and deadlines. The 0% VAT rate may be applied to an advance **provided the taxpayer holds documentation confirming export of the goods outside the EU within 6 months counted from the end of the month in which the advance was received (Article 41(9a)). Otherwise, the taxpayer must adjust the VAT return in which the advance was reported and tax the amount at the domestic VAT rate (23% or the applicable reduced rate). If the export evidence is obtained later, the supplier may correct the transaction back to the 0% rate in the period the confirmation is obtained.

Short tax year and calendar year considerations

VAT is settled by monthly or quarterly periods. An advance received at the year‑end belongs to the period of receipt. It does not shift to the following year merely because delivery occurs later. The final invoice aligns the taxable base, but the VAT on the advance remains in the period of receipt. This follows from Article 19a(8) and the periodic settlement mechanics of VAT returns and JPK_VAT.

Invoicing mechanics

How to invoice the client: partial payment, full amount, premium

- Deadline to issue: If payment is received before supply, issue the advance invoice no later than the 15th day of the month following the month of receipt. Do not issue earlier than 60 days before the supply or the receipt of payment. These limits apply to advance invoices as well.

- 60‑day earliest issue rule: Issuing an advance invoice earlier than 60 days before the relevant event may be treated as documenting an activity that did not occur, exposing the supplier to VAT risk and the need to correct the invoice. Recent practice confirms this approach.

- Tax base and VAT amount: VAT due on the advance is calculated from the gross amount received, applying the VAT rate appropriate to the future supply. If the advance covers 100%, the final invoice may end up zero‑valued (only linking and settling), provided legal conditions are met.

Final invoice and use of advance

After the supply, issue a final invoice that settles all advances. It must list the numbers/KSeF identifiers of prior advance invoices and deduct the amounts already taxed, showing only the remaining amount. For structured e‑invoices (KSeF) the identifiers become part of the settlement reference.

Refund or repayment of the advance

If the underlying transaction will not occur and the supplier returns the advance (in whole or part), the supplier issues a correcting invoice reducing the tax base. Practice and individual rulings indicate that a refund to the buyer is the standard condition for reducing output VAT on the original advance invoice; documentation of the refund should be kept.

Special cases

Goods vs services and use of intellectual property

The receipt‑of‑payment rule in Article 19a(8) applies to goods and services alike. For continuous services or those settled in settlement periods, different timing rules may apply under Article 19a(3)–(5); the 60‑day earliest issue rule also lists exceptions for certain periodic supplies, provided the invoice states the settlement period. Review contract wording to match the performance obligation and the VAT rate that will apply.

Payments with respect to financial services

Many financial services are VAT‑exempt; if the future supply is exempt, an advance does not generate VAT due, but still may need to be invoiced or documented per Article 106b and commercial practice. Always verify whether the future service is taxable or exempt before issuing an advance invoice and charging VAT.

Cross‑border supplies and currency issues

- ICS/WDT advances: no tax point at receipt of goods (see above).

- Foreign currency advances: For VAT reporting, VAT amounts must be converted to PLN. The exchange rate is usually the ECB or NBP average rate of the business day preceding the emergence of the tax obligation (here: receipt date for advances). Ensure consistency between the advance and final invoice.

- Export of services with reverse‑charge or out‑of‑scope place of supply may be VAT‑neutral domestically; check the place‑of‑supply rules before charging VAT on an advance.

Compliance checklist

Documentation: receipt, VAT invoice, contracts

- Proof of payment received (bank statement, POS confirmation).

- Advance invoice containing elements from Art. 106f(1), including the amount received and VAT due.

- Final invoice referencing earlier advances and, in KSeF, listing relevant identifiers.

Deadlines: 60 days and the 15th day rule

- Issue deadline: by the 15th day of the month after receipt.

- Earliest issue: not earlier than 60 days before supply or receipt, subject to statutory exceptions for certain periodic supplies.

Common errors

- Issuing an advance invoice too early (before the 60‑day window).

- Treating a ICS/WDT advance as taxable in Poland without exceptions.

- Failing to reference advance invoices on the final invoice as required by Art. 106f.

- Omitting VAT amount currency conversion or using the wrong ECB/NBP rate date.

- Not issuing a correction when the advance is refunded.

- Not issuing an advance invoice at all.

Worked examples

1. Partial payment and final invoice in the year of delivery

Scenario: Poland’s domestic transaction. PLN 50,000 order at 23% VAT. Customer pays a PLN 10,000 advance on 10 March. Delivery on 20 April.

VAT consideration:

| Tax point | 10 March |

| Advance amount (gross) | 10,000 |

| VAT rate | 23% |

| VAT due on advance | 10,000 × 23/123 = 1,869.92 |

| Advance invoice deadline | By the 15th day of the month following the tax point for advance. |

| Final invoice | Delivery in April, deadline — by 15th day of the month following a delivery. VAT only on remaining amount. |

2. Advance received in December, delivery next year

- Scenario: Poland’s domestic transaction. PLN 40,000 order at 8% VAT. Advance PLN 20,000 on 27 December. Delivery on 15 January. VAT consideration:

| Tax point for advance | 27 December |

| Advance amount (gross) | 20,000 |

| VAT rate | 8% |

| VAT due on advance | 20,000 × 8/108 = 1,481.48 |

| Advance invoice deadline | By the 15th day of the month following the tax point for advance. |

| Remaining VAT timing | January, when supply occurs |

| Final invoice | Delivery in January; deadline — by the 15th day of the month following delivery; VAT only on remaining amount. |

3. Advance refunded before performance

- Scenario: PLN 12,300 gross advance received and invoiced in July. Contract terminated in August; supplier returns the advance on 31 August.

- VAT: Issue a correcting invoice in August reducing the tax base to zero; keep evidence of the refund.

4. Advance on ICS/WDT (intra‑Community supply of goods)

Scenario: Supply from Poland to Germany (ICS/WDT). Order value PLN 100,000. Advance PLN 30,000 received on 12 May. Delivery on 28 June. The buyer holds a valid EU VAT number, and the supplier holds alla required evidence of the ICS/EDT

VAT consideration:

| Is VAT due on the advance? | No. An advance for ICS/WDT does not trigger a VAT tax point in Poland. |

| Advance amount (gross) | 30,000 |

| Tax point for ICS/WDT | Date of issuing the WDT invoice or the 15th day of the month following the month of delivery, whichever occurs first. For a June delivery — no later than 15 July. |

| Advance invoice | Not applicable for ICS/WDT (no VAT advance invoice obligation). |

| Final WDT invoice | Issue by 15 July; apply 0% provided the WDT conditions are met. |

| 0% rate conditions | Movement of goods from Poland to another EU Member State, buyer’s valid EU VAT number, inclusion in the EC Sales List (VAT‑UE), and possession of transport evidence, correct settlement of the transaction in the ECSL reporting. |

| No documents by deadline | If by the JPK_V7 filing deadline for the delivery period you still lack ICS/WDT evidence, wait one more settlement period. You may apply 0% if the evidence is obtained by the filing deadline for the next period. Only if it is still missing by that next deadline must you tax the sale at the domestic VAT rate. When evidence is obtained later, correct back to 0%. |

FAQs

Do I always have to issue an advance invoice if I receive a payment?

If the advance and the supply occur in the same month, practice allows documenting the sale with a single final invoice that settles the payment, without a separate advance invoice. Otherwise, an advance invoice is required.

Is an advance invoice required for WDT?

No. An advance for intra‑Community supply of goods does not trigger a tax point in Poland; VAT obligation arises on invoice issue or by the 15th day of the month after the delivery month.

What happens if I issued an advance invoice more than 60 days early?

Tax authorities treat it as premature; you may need to correct it to avoid VAT on a non‑event.

What must an advance invoice contain?

Elements under Art. 106f(1), including seller and buyer data, as well as the amount received and VAT due; and on the final invoice, references to prior advance invoices (including KSeF identifiers where applicable).

Conclusion

For Polish VAT purposes, an advance payment is a payment received that triggers VAT at receipt, except where the law provides otherwise, notably for WDT. Ensure correct timing (15th day rule and 60‑day earliest issue), accurate VAT rate, proper settlement on the final invoice, and corrections where advances are refunded. These steps reduce risk and keep the amount of tax and reporting in the correct period.

Sources

- Polish VAT Act: Act of 11 March 2004 on tax on goods and services (Journal of Laws of 2024, item 361, as amended)

- https://eureka.mf.gov.pl/:

- Tax ruling concerning no tax liability in connection with issuing an advance payment invoice for an intra-Community supply: 0115-KDIT1-3.4012.880.2018.1.APR

- Tax ruling concerning the creation of a tax liability in connection with intra-Community supply of goods: 0114-KDIP1-2.4012.455.2024.1.MW

- Inforlex.pl:

- Gofin.pl

- Rachunkowosc.pl

As from 1st January 2022 the art. 106i Polish VAT Act has been changed. Now, the taxpayer has a right to issue an invoice maximum 60 days preceding the delivery of goods, performance of services or receipt of all or part of a payment (earlier it was 30 days).

Generally, in accordance with the art. 19a Polish VAT Act, the tax obligation arises when the goods are delivered or the services are performed. However, if all or part of the payment is received before this date, the tax point arises upon its receipt in relation to the amount of advance payment.

This leads to the question, when does the tax obligation arise for an advance invoice issued maximum 60 days before receiving the advance payment? Regardless of the fact that the taxpayer issued the advance payment invoice before the receipt of the advance payment, the tax obligation arose in a date when the taxpayer received the advance payment.

For example, the taxpayer issued an advance payment invoice on 25th April 2022. He received the money on 18th June 2022. Based on the above rules, the VAT obligation arose on 18th June 2022.

If the taxpayer issues an advance invoice but does not receive the payment within 60 day, it can be assumed that this is the so-called “empty invoice”. Thus, the information contained in such a document is not factually correct and empty invoices are not included in the JPK_V7 file. This was confirmed by a few court judgements e.g. judgment of the Supreme Administrative Court (NSA) of 4 December 2009, file ref. act I FSK 1859/08, judgement of the Supreme Administrative Court (NSA) of 19 January 2010 r., file ref. act I FSK 1759/08.

Read more about our VAT Reporting Services https://polishtax.com/services/vat-reporting-poland/