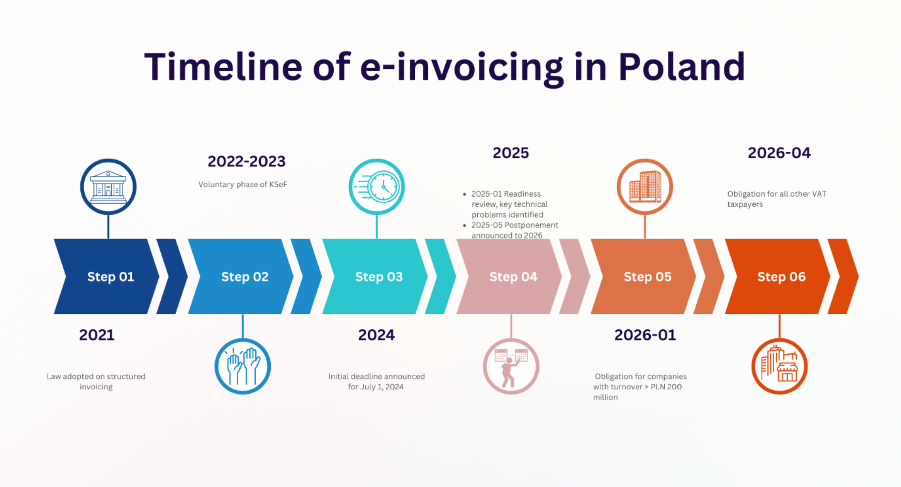

The Polish Krajowy System e-Faktur (KSeF), or National e-Invoicing System, will become mandatory from February 1, 2026 for large taxpayers and from April 1, 2026 for others. After several delays, including a key postponement announced in June 2025, the e-invoicing system is set to replace traditional invoicing practices in the country. This article explains the implementation schedule, the core elements of the KSeF procedure, its legal foundation, and the obligations for entrepreneurs and accountants.

Table of Key KSeF Facts and Explanations

| Fact/Aspect | Explanation |

| System Name | Krajowy System e-Faktur (KSeF) (The National e-Invoicing System) |

| Type of Invoicing | e-Faktura (structured electronic invoice) |

| Legal Obligation Start Dates | February 1, 2026 (VAT payers with turnover > PLN 200 million); April 1, 2026 (others) |

| Responsible Body | Polish Ministry of Finance (Ministerstwo Finansów) |

| Format | XML-based structured invoice schema |

| Access Method | API integration or taxpayer’s application portal |

| Law Regulating KSeF | Act of March 18, 2021 on National e-Invoicing System (Ustawa o Krajowym Systemie e-Faktur), VAT Act |

| Penalties | Non-compliance penalties starting July 1, 2026 |

The KSeF System: What It Is

The Krajowy System e-Faktur (KSeF) is an electronic invoicing system developed by the Polish Ministry of Finance. It is designed to standardize invoice issuance, storage, and access by both businesses and the tax authority. The system ensures that structured invoices (e-faktury) are transmitted, validated, and archived through a centralized database.

Why KSeF Becomes Mandatory

- Enhance tax collection

- Prevent VAT fraud

- Digitize and automate invoicing

- Simplify cross-border cooperation

- Align with EU digital reporting standards (e.g., ViDA proposals)

Impact on Entrepreneurs and Taxpayers

Who Must Comply?

- All VAT-registered and established taxpayers in Poland

- Both B2B and B2G transactions (so fat B2C transactions are excluded)

There is uncertainty regarding whether entities with a fixed establishment in Poland are required to use the KSeF system. The Ministry of Finance states that these entities have to follow the new rules; however, the EU derogation decision permits implementation of the e-invoicing system solely for entities established in Poland. This situation may result in differing interpretations by tax offices and further discussions with tax authorities, however, in our opinion the article 1 of a Council implementing decision (EU) 2022/1003 is straight:

“By way of derogation from Article 218 of Directive 2006/112/EC, Poland is authorized to only accept invoices which have been issued by taxable persons established in the territory of Poland in the form of documents or messages in electronic format.”

Still it is advised to apply for official tux ruling or follow the new Polish VAT law regulations to avoid disputes with the tax office.

What KSeF Replaces

KSeF will replace PDF, paper, and non-standard electronic invoices. It ensures:

- Real-time validation by tax authority

- Uniformity of invoice data

- Automated archiving for 10 years

- Possibility of quick analyses of data included in invoices by the tax office.

Key Tasks for Businesses in short term timeline.

- Upgrade or integrate accounting systems

- Train accounting teams

- Appoint user access rights in KSeF for both own employees and tax agents

- Use trusted profile or qualified signature to authenticate

Penalties and Sanctions

Starting July 1, 2026, an official administrative penalties will apply for:

- Non-use of KSeF when required

- Incorrect issuance of structured invoices

- Failure to report within deadlines

- Not mentioning a KSeF invoice number in a wire transfer.

Exemptions and Special Cases

- Foreign taxpayers without Polish VAT number: exempt

- B2C invoices not covered

- Invoice correction notes (not all types) might follow separate path

- Small-value invoices may be issued via cash registers until July 31, 2026.

- Government may delay penalties until late 2026 or 2027.

Preparing for the Rollout: What to Do in 2025

With Poland’s National e-Invoicing System (KSeF) becoming mandatory on January 1, 2026, businesses need to proactively prepare throughout 2025 to ensure smooth compliance. Here are essential steps businesses should follow:

Evaluate Current Invoicing Processes

Begin by thoroughly reviewing your current invoicing methods and procedures. Identify areas requiring adjustments to integrate seamlessly with KSeF. This includes assessing the compatibility of your existing accounting software with the new system.

Select Appropriate Software and Tools

Ensure your accounting software provider is developing or has already introduced KSeF-compatible solutions. Engage in discussions early with your provider to understand timelines, capabilities, and costs associated with software updates or changes.

Implement Necessary IT Changes

Coordinate with your IT department or external service providers to implement the necessary technical changes. This includes integrating your invoicing system with KSeF and conducting comprehensive testing to eliminate any technical issues ahead of the rollout.

Staff Training and Awareness

Conduct thorough training sessions for your finance and administrative staff on how KSeF operates. Familiarize your team with the new processes for issuing, receiving, and archiving structured invoices to minimize disruptions post-implementation.

Compliance and Legal Review

Regularly monitor updates and guidelines provided by the Ministry of Finance regarding KSeF requirements. Ensure legal and regulatory compliance by consulting experts or attending dedicated workshops to fully understand obligations under the new system.

Pilot Phase and Testing

Participate in any available pilot programs offered by the Ministry of Finance or third-party providers. Testing your systems through pilot schemes will help identify and resolve potential issues in advance.

Communication with Business Partners

Inform your clients, suppliers, and partners early about your planned transition to KSeF. Clear communication will facilitate seamless business operations and prevent confusion during the transition phase.

By actively engaging in these preparatory actions throughout 2025, your business will be well-positioned for a smooth transition to the mandatory use of the National e-Invoicing System starting January 1, 2026.

Official Sources and Legal References

- Ministry of Finance portal: https://www.podatki.gov.pl/ksef/

- Legal Act regarding KSeF: The VAT Act, as well as current amendment that is presently under consideration in parliament. https://www.sejm.gov.pl/sejm10.nsf/PrzebiegProc.xsp?nr=1407

- Announcement on delay: https://dziennikustaw.gov.pl/DU/2024/852

Q&A: Common Questions About KSeF

Q1: When exactly does KSeF become mandatory?

A: February 1, 2026 for large taxpayers (>PLN 200M revenue), and April 1, 2026 for all others.

Q2: Is it still possible to use paper or PDF invoices in Poland?

A: No, after the deadlines new e-invoicing system in Poland will be the sole legal method of invoice issuance.

Q3: How do I register for KSeF?

A: Via the official government application using ePUAP or qualified electronic signature.

Q4: What are the penalties for non-compliance?

A: Financial penalties starting July 2026, including fines per faulty invoice or delay.

Q5: What is the role of API?

A: It enables accounting software to communicate directly with KSeF for seamless invoice exchange.