Definition of e-services for VAT purposes

For VAT purposes within the European Union, the term “electronically supplied services (e‑services)” refers to services delivered via the internet or an electronic network, where delivery is automated and requires minimal or no human intervention. Typical examples of e-services include:

- Downloadable software and applications,

- Streaming and broadcasting services,

- Online newspapers and e-books,

- Digital content such as music, films, or games,

- Online courses that are automatically delivered over the internet.

These electronically supplied services differ from traditional services due to the fact that the internet is the main channel of provision and the service is designed to be automatically delivered without individual customization.

Place of supply rules for digital services

The place of supply rules are crucial for determining where VAT is due. Within the EU VAT framework, the rules distinguish between B2B (business-to-business) and B2C (business-to-consumer) transactions:

- B2B transactions – the customer’s country determines the place of taxation. In practice, VAT is often subject to the reverse charge mechanism, meaning the customer accounts for VAT. It is important to note that VAT legislation provides various exceptions to this general rule; however, a detailed discussion of these exceptions falls outside the scope of this overview and will be addressed in a separate publication.

- B2C transactions – by the rule, VAT is due in the customer’s Member State. This is particularly relevant for companies supplying digital services to EU consumers.

For example:

- A German business purchasing a cloud service from a US provider – no VAT in Poland; reverse charge applies in Germany.

- A private Polish consumer buying e-books from a Canadian provider – Polish VAT is due, and the foreign supplier must register for VAT or use OSS scheme.

VAT registration obligations in Poland for foreign providers

Foreign companies supplying digital services to Polish consumers may be required to register for VAT in Poland. The key rules are:

- General threshold – Poland applies a PLN 200,000 (approx. EUR 47,000) annual turnover threshold for local small businesses. However, non-resident providers are generally required to register from the first sale, unless they use an EU-wide scheme.

- OSS (One Stop Shop) – EU and non-EU providers can simplify compliance by registering in a single Member State and reporting VAT due in multiple EU countries.

SME exemption (special scheme from 2025)

From 1 January 2025, new EU rules introduce a special SME scheme that may apply also in Poland (EU SME VAT rules). This scheme is designed to reduce VAT compliance costs for small businesses:

- Eligible if annual EU-wide turnover ≤ EUR 100,000.

- Sales in Poland must not exceed PLN 200,000.

- Available only to companies established within the EU.

Practical consequences:

- SMEs can remain VAT exempt in Poland while supplying digital services cross-border.

- They must notify their home tax authority, which confirms their eligibility and issues an EX number valid across the EU.

- SMEs under this scheme file simplified quarterly reports instead of full VAT returns.

If the limits are exceeded, the provider must register for VAT in Poland immediately and comply with standard VAT obligations.

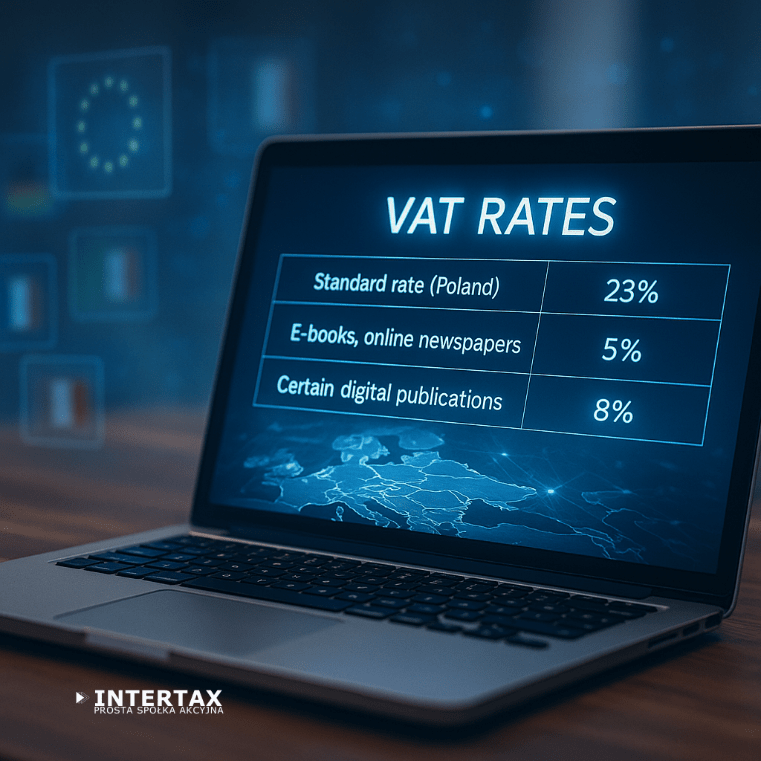

VAT rates applicable to e-services

The standard VAT rate in Poland is 23%, applicable to most electronically supplied services. However, reduced rates may apply to certain services:

- E-books and online newspapers – subject to the 5% reduced VAT rate,

- Some digital publications – may qualify for an 8% VAT rate.

These rates differ across EU Member States, making compliance more complex for companies supplying digital services cross-border. Accordingly, businesses engaged in cross-border sales within the EU must ensure that their sales processes are compliant with the VAT regulations and VAT rates of each destination country.

VAT compliance and reporting obligations

Companies supplying e-services in Poland must ensure VAT compliance by:

- Registering for VAT (unless exempt under the SME scheme or OSS scheme),

- Charging the correct VAT rate,

- Issuing invoices in line with Polish VAT rules,

- Filing VAT returns (monthly or quarterly),

- Making timely VAT payments to the Polish tax authorities.

Failure to comply may result in penalties, interest charges, and deregistration. Foreign providers must take particular care to comply with the VAT rules to avoid double taxation or disputes with tax authorities.

Special considerations for non-EU companies

Providers established outside the EU face stricter rules:

- They cannot benefit from the SME exemption.

- They must either establish a fiscal representative and register for VAT in Poland or use the non-Union OSS scheme.

- VAT obligations arise from the first supply of digital services to Polish consumers.

This means that non-EU digital service providers must be especially proactive in ensuring VAT compliance in Poland.

Practical examples of e-services subject to VAT in Poland

Key takeaways and compliance strategy

- Companies supplying digital services to Polish consumers are generally required to register for VAT in Poland or use OSS.

- From 2025, EU-based SMEs may benefit from the special SME scheme, reducing compliance burdens.

- Correct VAT rates must be applied, with reduced rates available for e-publications.

- Non-EU providers cannot use the SME exemption and must ensure compliance from the first sale.

To ensure compliance, foreign providers should:

- Assess whether they qualify for the SME scheme,

- Register under the OSS system where possible,

- Monitor turnover thresholds carefully,

- Seek professional advice to avoid penalties.