Executive Summary

The call-off stock arrangement is a mechanism established in order to allow supplier of goods to avoid VAT registration in Member State of destination. In the article below you will find a clear overview of how call-off stocks are regulated in Poland, what conditions must be met, what must be reported and which pitfalls most often violate the simplification.

In international trade in goods, a common business model of transactions is operations carried out through warehouses located in another country. Generally, in such cases, the goods stored in the warehouse remain the property of the foreign entrepreneur, and the ownership right usually passes to the buyer at the time of collection from the warehouse. In the case of the call-off stock arrangements, a foreign company generally has one regular counterparty. The buyer of the goods is already identified at the time of moving the goods to such a warehouse. Goods are stored in a warehouse in order to ensure a constant supply for the buyer, who most often consumes the purchased goods for production purposes. Moreover, a foreign entrepreneur is often required to keep a certain amount of goods in stock to ensure continuity of supply. Transactions are made primarily on the basis of the sale of goods, according to which the buyer usually has the right to freely take goods from the warehouse as needed.

On 1 December 2008, amendment 1 to the Value Added Tax Act 2 came into force, which introduced simplifications for transactions carried out through the so-called consignment warehouses. However, the scope of application of simplifications in practice has been very limited. A significant change in the regulations was introduced in 2020. The EU has introduced the Quick Fixes package – including the call-off stock procedure (Article 17a of the VAT Directive). Poland implemented these changes with the Quick Fixes Act.

Currently Call-off stock is one of the most practical VAT simplifications for intra-EU supply chains. It allows goods to be moved to a warehouse in another EU Member State without triggering an immediate “own goods transfer” as an intra-Community supply/acquisition, provided that a pre-identified customer will later “call off” (take) the goods and acquire title at that moment.

What is a call-off stock arrangement?

In a classic model, a supplier transports goods to a warehouse in another EU country so they are available “on demand” for a specific customer. The customer becomes the owner only when the goods are withdrawn from the warehouse.

Without a simplification, this movement of goods is typically treated as a taxable “transfer of own goods” (a deemed intra-Community supply and acquisition), often forcing the supplier to register for VAT in the Member State of destination.

The call-off stock simplification postpones VAT recognition until the customer actually takes the goods.

Legal framework in Poland: where are the rules?

Poland implemented the EU “Quick Fixes” rules on call-off stock into the Polish VAT Act. In practice, Polish regulations cover both directions:

- Goods moved to Poland under a call-off stock model (foreign supplier → Polish warehouse/customer), and

- Goods moved from Poland to another EU Member State (Polish supplier → foreign warehouse/customer).

These rules are part of the harmonised EU approach introduced from 2020 and are designed to reduce foreign VAT registrations in genuine call-off stock scenarios.

Key conditions to apply call-off stock (Polish perspective)

While each supply chain should be assessed individually, the simplification generally requires that all of the following conditions are met:

A. The customer is known in advance

The supplier must know the customer’s identity and valid VAT ID in the destination Member State at the start of transport.

B. A prior arrangement exists

There must be an agreement that the identified customer will be entitled to take the goods from the call-off stock warehouse at a later stage.

C. No fixed establishment in the destination country

The supplier must not have a seat or fixed establishment in the Member State where the warehouse is located (this point is often scrutinised in audits).

D. Proper record-keeping

Both supplier and customer must maintain the required call-off stock records (detailed movements, dates, quantities, substitutions, returns, etc.).

E. Reporting obligations are met

The supplier must include the movement in the EU recapitulative statement (VAT-UE) with the customer’s VAT ID (and later report the intra-Community supply when ownership transfers).

F. The 12-month time limit

As a rule, the customer must take ownership within 12 months from the date the goods entered the call-off stock warehouse. If the time limit is exceeded, the simplification typically collapses.

VAT treatment: when do WDT and WNT happen?

The “logic” of call-off stock is simple:

(1) Movement of goods to the warehouse

If conditions are met, the movement is not treated as an intra-Community supply/acquisition at that time.

(2) Withdrawal (“call-off”) by the customer

When the customer withdraws the goods and obtains the right to dispose of them as owner, the transaction is recognised as:

- WDT (intra-Community supply) by the supplier in the Member State of dispatch, and

- WNT (intra-Community acquisition) by the customer in the Member State of destination.

This is exactly the benefit: VAT is aligned with the commercial moment of transfer of title, rather than the earlier logistics movement.

Reporting & documentation: what must be done in practice?

In a compliant call-off stock model, formalities matter as much as the commercial reality. From a Polish compliance standpoint, the key elements usually include:

- Call-off stock ledger / register (supplier and customer):

dates of dispatch and arrival, identification of goods, quantities, warehouse address, customer’s VAT ID, dates of withdrawals, returns, substitutions, and any “end of procedure” events. - VAT-UE reporting:

the movement under call-off stock is reported in the recapitulative statement, and the later intra-Community supply is reported when the customer takes the goods. - Transactional documentation for the eventual WDT:

when the goods are withdrawn, you still need to meet the standard requirements for applying the 0% VAT rate on WDT (including transport evidence and correct reporting).

In real life, the compliance workflow should be set up together with logistics, the warehouse operator and the ERP team—because small operational gaps (missing dates, unclear SKU mapping, late reporting) can undermine the simplification.

What breaks the simplification? Common “red flags”

Call-off stock can stop applying (or be denied in an audit) for a number of reasons. The most frequent ones include:

- Customer changes (the goods end up being sold to a different buyer than initially declared),

- The 12-month deadline is missed,

- Loss, theft or destruction of goods in the warehouse (depending on facts and timing),

- Supplier obtains a fixed establishment in the destination country (e.g., by using resources there in a way that constitutes a FE),

- Missing or inconsistent records, or

- Incorrect/incomplete VAT-UE reporting.

When the simplification fails, the tax consequences can be significant: the movement may be reclassified into a deemed intra-Community supply/acquisition, which may create retroactive reporting corrections and, in some cases, VAT registration obligations abroad.

Practical compliance checklist (recommended)

If you want call-off stock to withstand scrutiny, we recommend verifying the following before the first shipment:

- Confirm the customer is VAT-registered in the Member State of destination and validate the VAT ID.

- Put in place a written call-off stock arrangement (commercial and logistics terms).

- Verify the supplier has no fixed establishment in the destination country.

- Agree with the warehouse how stock movements are recorded and how withdrawals are confirmed.

- Configure the ERP/accounting workflow so that:

- the movement is captured for call-off stock reporting, and

- the WDT/WNT is triggered on withdrawal.

- Monitor the 12-month deadline.

- Prepare a “failure protocol” (what to do if goods are returned, substituted, destroyed, or the customer changes).

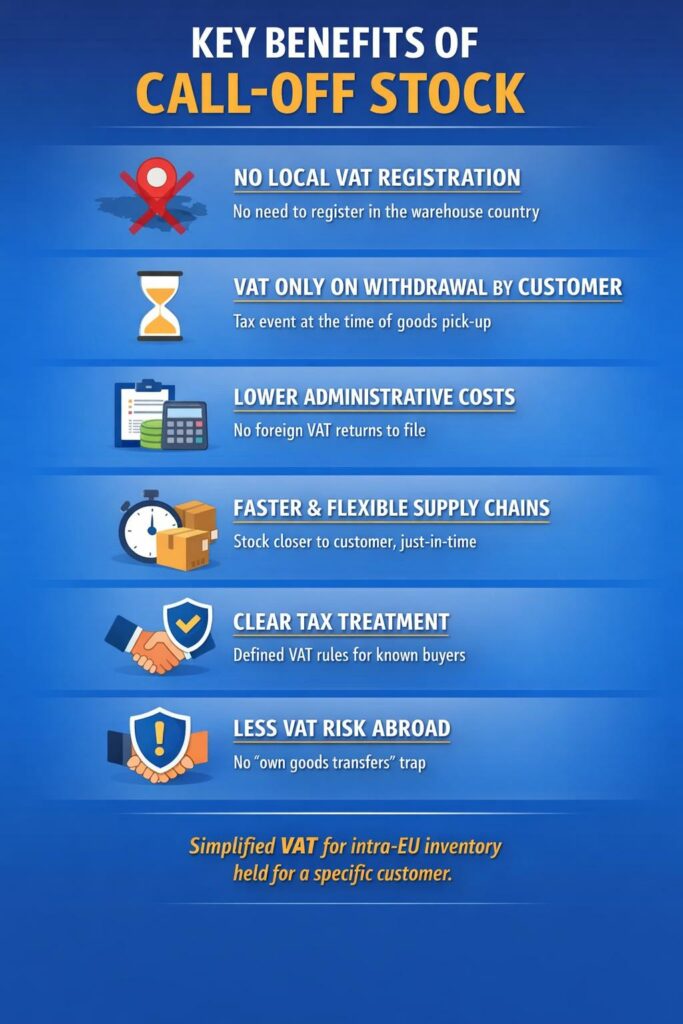

The main benefits

The main benefits of call-off stock (in the EU/Poland context) are very practical – primarily compliance + costs + liquidity:

- No (or significantly reduced) VAT registration requirement in the warehouse’s country.

If you meet the call-off stock requirements, simply transferring goods to a warehouse in another EU country usually does not require the supplier to register for local VAT (because there is no “transfer of own goods” as ICT/ICT from the outset).

- You recognize VAT only when the customer collects the goods.

Delivery/ICT and ICT are “triggered” upon collection by the designated buyer, not on the date the goods physically arrive at the warehouse. This often improves cash flow and settlement timing.

- Less administration and lower costs of handling foreign VAT

Local declarations, JPK/VAT returns abroad, local invoicing, proxy management, correspondence with authorities, inspections, etc. are often eliminated.

- Simpler and more secure supply chains (especially JIT)

You can keep goods closer to the recipient and shorten lead times, without the “penalty” of immediate VAT settlements on the movement itself.

- Greater tax predictability in models with a single recipient

If you actually have a pre-defined buyer, call-off stock provides clear qualification and reduces disputes over whether a “transfer of own goods” has occurred.

- Reduced risk of errors compared to “consignment stock” without simplification

In a classic consignment arrangement (with multiple potential buyers), it’s easy to get caught up in registration obligations and local deliveries. Call-off stock – if met – “closes” this problem.

Important: the benefits are real only if the conditions are met (including a buyer known in advance, records, reporting, 12-month limit).

How we can help

At Intertax we support businesses implementing call-off stock in Poland and across the EU, including:

- transaction mapping and tax risk assessment (including fixed establishment analysis),

- compliance setup (registers, VAT-UE reporting workflow, ERP alignment),

- ongoing VAT compliance and audit support, and

- review of existing call-off stock arrangements already operating in your supply chain.

If you would like us to review your specific flow (to Poland or from Poland), send us the high-level process description (countries, parties, warehouse model, Incoterms and ownership transfer point) and we will propose the safest approach.