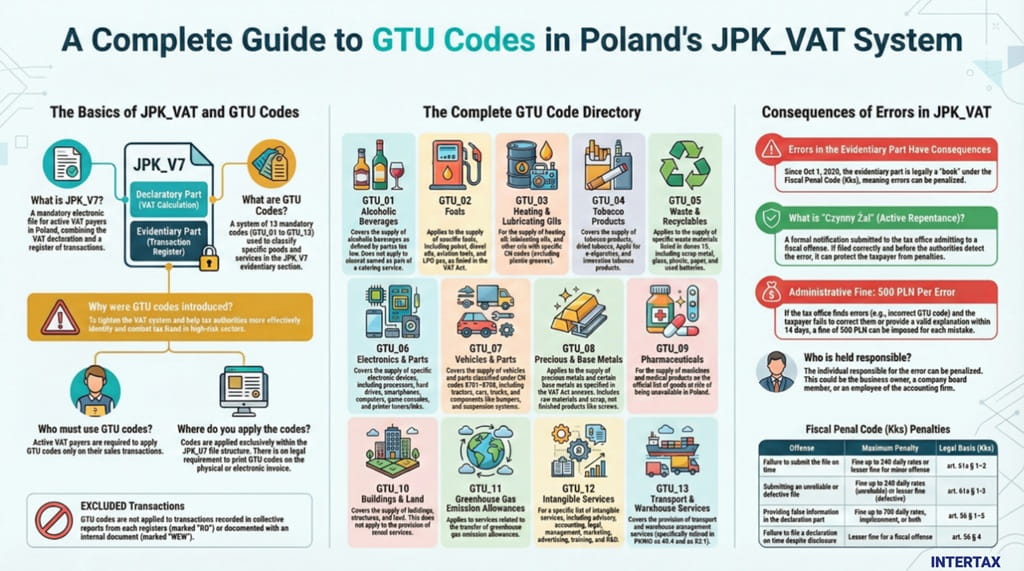

Executive Summary

GTU codes are 13 labels (GTU_01–GTU_13) used to mark certain goods and services in the SAF‑T JPK_V7 file. You do not put GTU on invoices; you report it in the sales register of the JPK_V7 (V7M or V7K). If the tax office finds errors that prevent verification and you do not correct/explain them in 14 days, the head of the tax office may impose a 500 PLN administrative fine per error. Corrections are made by resubmitting a full corrected XML (and, if appropriate, lodging an “active repentance” letter under the Fiscal Penal Code).

Introduction: Navigating Poland’s Modern VAT Landscape

Since October 1, 2020, Polish VAT reporting has been fundamentally transformed by the introduction of the JPK_V7 (Jednolity Plik Kontrolny, or Standard Audit File for Tax). This new digital reporting standard integrates the previously separate VAT-7 (monthly) and VAT-7K (quarterly) declarations with a detailed, transaction-level data file. This consolidation marks a significant step in the digitalization of Poland’s tax administration, aiming to streamline compliance for businesses while enhancing the analytical capabilities of tax authorities.

A critical component of this new system is the set of GTU (Grupy Towarowo-Usługowe, or Goods and Services Groups) codes. These mandatory markers are used to classify specific types of transactions within the JPK_V7 file, targeting sectors historically vulnerable to tax fraud. The purpose of this guide is to provide a clear, comprehensive, and practical explanation of what GTU codes are, who must use them, how to apply them correctly, and the significant consequences of reporting errors.

Mastering the correct GTU classification is no longer optional; it is essential for maintaining VAT compliance in Poland. A thorough understanding of these codes is crucial for businesses to navigate the modern tax landscape successfully and avoid potentially costly financial penalties.

1. The Foundation: Understanding the JPK_V7 Framework

The JPK_V7 file is the cornerstone of modern Polish VAT reporting. This shift towards granular, real-time data submission is part of a global trend in tax administration, strategically designed to simplify the compliance process for taxpayers while providing tax authorities with a powerful, data-rich tool for real-time analysis and efficient risk assessment.

What is JPK_V7?

The JPK_V7 file replaced the dual system of submitting separate VAT-7 (monthly) or VAT-7K (quarterly) declarations alongside the old JPK_VAT transactional file. The new, integrated JPK_V7 structure consists of two distinct but interconnected parts:

- A declarative part, which contains the summary data previously found in the traditional VAT return.

- An evidentiary part, which is a detailed, line-by-line register of all sales and purchase transactions for the reporting period.

A critical legal change accompanied this reform. Since October 1, 2020, the evidentiary part of the JPK_V7 is legally considered a “księga” (an official tax book or ledger) under the Polish Fiscal Penal Code (Kodeks karny skarbowy, KKS), as defined in art. 53 § 21 pkt 3 KKS. This reclassification significantly increases the legal responsibility of taxpayers for the accuracy and completeness of the transactional data reported, including the correct application of GTU codes.

JPK_V7M vs. JPK_V7K: What’s the Difference?

Taxpayers submit one of two versions of the JPK_V7 file, depending on their VAT settlement frequency.

| JPK_V7M (Monthly Filers) | JPK_V7K (Quarterly Filers) |

| For new taxpayers, or taxpayers who file their VAT returns on a monthly basis. | For taxpayers who are VAT taxpayers at least for 12 continues months and file their VAT returns on a quarterly basis. |

| They submit the complete file, containing both the declarative and evidentiary parts, by the 25th of the following month. | They follow a unique submission schedule: the evidentiary part is submitted monthly, while the declarative part is submitted only once per quarter (by the 25th of the month following the end of the quarter). |

Understanding this fundamental structure is the first step toward navigating Polish VAT compliance. We now turn to a specific, and crucial, element within that framework: the GTU codes.

See also: VAT obligations & deadlines in Poland.

2. Core Principles of GTU Reporting

GTU codes are a core element of the JPK_V7’s evidentiary part, representing a key mechanism for the Ministry of Finance to “seal” the VAT system. Their primary purpose is to enable tax authorities to more efficiently identify and monitor transactions in sectors particularly susceptible to tax fraud and abuse, such as the trade in alcohol, fuel, electronics, and certain intangible services. By flagging these specific transactions, the system allows for targeted and automated analysis of high-risk areas.

Core Principles of GTU Codes

The application of GTU codes is governed by a set of clear, fundamental rules:

- Who has the obligation? The requirement to use GTU codes applies exclusively to sellers who are active VAT taxpayers in Poland. This is a critical distinction: buyers do not mark GTU codes in their purchase records, even when acquiring goods or services that fall into a GTU category.

- Where are they applied? GTU codes are only marked within the electronic structure of the JPK_V7 file itself. They are a reporting requirement, not a documentation requirement for other business records.

- How are they applied? The technical application is straightforward. For a given sales transaction that falls under a specific GTU category, the taxpayer activates a flag by marking ‘1’ in the dedicated field for the relevant code (e.g., GTU_01, GTU_02) for the specific invoice entry in the evidentiary part of the JPK file. If a transaction does not fall under any GTU category, these fields are left blank.

How to Label Invoices with GTU Codes: A Common Question

A frequent question among businesses is whether GTU codes must be printed on the physical or electronic invoices issued to customers.

Based on Polish VAT regulations, there is no legal requirement to include GTU codes on the sales invoice itself. The obligation is limited to the JPK_V7 file submitted to the tax authorities.

However, while not mandatory, some businesses choose to include this information on their invoices for internal accounting clarity, to aid in JPK file preparation, or for transparency with business partners. This practice is not forbidden and is a matter of internal business policy.

Related reading on our site: Invoicing in Poland 2025–2027: VAT & KSeF.

3. The Complete Guide to All 13 GTU Codes

Correctly classifying goods and services is a strategic imperative for every active VAT taxpayer in Poland. An error in classification can lead to an incorrect JPK_V7 file and potential penalties. The following section provides a detailed and practical breakdown of each of the 13 GTU categories. The scope of these codes is often defined by referencing official classifications, such as the EU’s Combined Nomenclature (CN) for goods or the Polish Classification of Goods and Services (PKWiU).

GTU_01: Alcoholic Beverages

- Description: Delivery of alcoholic beverages as defined by Polish excise tax regulations. This includes ethyl alcohol, beer, wine, fermented beverages, and intermediate products with an alcohol content exceeding 1.2% by volume, as well as mixtures of beer and non-alcoholic drinks with an alcohol content exceeding 0.5%.

- Scope and Key Examples (based on CN):

- CN 2203: Beer made from malt.

- CN 2204: Wine of fresh grapes, including fortified wines.

- CN 2205: Vermouth and other wine of fresh grapes flavoured with plants or aromatic substances.

- CN 2206: Other fermented beverages (e.g., cider, perry, mead); mixtures of fermented beverages and mixtures of fermented beverages and non-alcoholic beverages.

- CN 2207: Undenatured ethyl alcohol of an alcoholic strength by volume of 80% vol or higher; ethyl alcohol and other spirits, denatured, of any strength.

- CN 2208: Undenatured ethyl alcohol of an alcoholic strength by volume of less than 80% vol; spirits, liqueurs, and other spirituous beverages.

- Practical Application & Exclusions:

- Use GTU_01 for the invoiced sale of packaged alcoholic beverages (e.g., a bottle of wine, a case of beer). This applies to sales between businesses and to other entities receiving a VAT invoice.

- Use GTU_01 for gift baskets or sets containing alcohol. The code applies to the transaction as a whole if alcohol is a component.

- Do not use GTU_01 when alcohol is provided as part of a comprehensive gastronomic service (e.g., a glass of wine served with a meal in a restaurant). This is classified as a service (PKWiU 56), not a delivery of goods.

- Do not use GTU_01 for food products that contain alcohol as an ingredient (e.g., chocolates with liqueur), unless the final product itself is classified as an alcoholic beverage under excise law.

GTU_02: Fuels and Biofuels

- Description: Delivery of goods listed in Article 103(5aa) of the VAT Act, primarily covering motor fuels, aviation fuels, biofuels, and liquefied petroleum gas (LPG).

- Scope and Key Examples (based on CN):

- CN 2710 12 31: Aviation gasoline.

- CN 2710 12 41 to 2710 12 59: Motor gasoline.

- CN 2710 19 43, 2710 20 11: Diesel oils.

- CN 2711 12, CN 2711 13: Liquefied petroleum gas (LPG).

- CN 2710 19 62 to 2710 19 68, 2710 20 31 to 2710 20 39, 2710 20 90: Specific heating oils.

- CN 2207 20 00: Denatured ethyl alcohol used as a fuel component.

- Also includes liquid biofuels (biopaliwa ciekłe) as defined by Polish law.

- Practical Application & Exclusions:

- Use GTU_02 for any invoiced sale of these fuels, including wholesale distribution or retail sales from a fuel station documented with a VAT invoice.

- Do not use GTU_02 if the fuel cost is refactored as part of a larger, complex service (e.g., a transportation service) and is not itemized as a separate delivery of goods on the invoice.

- A product with code CN 2710 20 90 may require marking with both GTU_02 and GTU_03. Taxpayers must mark both fields in the JPK file in such cases.

GTU_03: Heating Oils and Lubricants

- Description: Delivery of heating oil, lubricating oils, and other specific oils as defined by excise law, primarily classified under CN codes 2710 and 3403.

- Scope and Key Examples (based on CN):

- CN 2710 19 71 to 2710 19 99: A wide range of oils including motor, compressor, turbine, hydraulic, and gear oils. This category explicitly excludes white oils, liquid paraffin (CN 2710 19 85), and plastic greases (within CN 2710 19 99).

- CN 2710 20 90: Other oils. As noted above, this code may also fall under GTU_02, requiring dual marking.

- CN 3403: Lubricating preparations, excluding plastic greases within this group.

- Practical Application & Exclusions:

- Use GTU_03 when selling containers of motor oil, delivering heating oil not covered by GTU_02, or selling specialized industrial lubricants.

- Do not use GTU_03 when oil is consumed as part of a service (e.g., an oil change at a garage), where the service itself is the main component of the transaction.

- Do not use GTU_03 for plastic greases, which are explicitly excluded.

GTU_04: Tobacco Products

- Description: Delivery of tobacco products, dried tobacco, liquid for e-cigarettes, and innovative tobacco products as defined by excise tax law.

- Scope and Key Examples:

- Cigarettes, cigars, and smoking tobacco.

- Dried tobacco (unprocessed).

- Liquid for use in electronic cigarettes (with or without nicotine), including base liquids containing glycol and glycerine.

- Innovative tobacco products (e.g., “heated tobacco” products).

- Practical Application & Exclusions:

- Use GTU_04 for any invoiced sale of these products, including wholesale, sales to retailers, and sales by farmers who are active VAT taxpayers.

- Do not use GTU_04 for nicotine replacement products (e.g., patches, gums) that are not classified as excise goods.

GTU_05: Waste and Recyclable Materials

- Description: Delivery of waste materials specified in items 79-91 of Annex 15 to the VAT Act.

- Scope and Key Examples (based on PKWiU):

- 38.11.49.0: Wrecks intended for scrapping (excluding ships).

- 38.11.51.0, 38.32.31.0: Glass waste and secondary raw materials from glass.

- 38.11.52.0, 38.32.32.0: Paper and cardboard waste and secondary raw materials.

- 38.11.55.0, 38.32.33.0: Plastic waste and secondary raw materials.

- 38.12.27: Waste from used cells and batteries.

- 38.32.2: Secondary metal raw materials (scrap metal).

- Practical Application & Exclusions:

- Use GTU_05 when selling segregated waste as a commodity (e.g., a business selling baled cardboard to a recycling plant).

- Use GTU_05 for the sale of used and non-functional electronics (e.g., computers for scrap). In contrast, used but functional electronics are marked with GTU_06.

- Do not use GTU_05 for waste collection or disposal services where there is no transfer of ownership of the waste as a tradable good.

- While the “MPP” marker in the JPK file is obsolete as of July 1, 2021, the underlying obligation to use the mandatory Split Payment Mechanism (MPP) for these transactions when they exceed 15,000 PLN remains in force under the VAT Act. Related reading: Split payment mechanism in Poland – extended until 2028.

GTU_06: Electronic Devices and Parts

- Description: Delivery of electronic devices and their parts and materials, as specified in certain items of Annex 15 to the VAT Act. The code applies to both new and used equipment.

- Scope and Key Examples (based on PKWiU):

- ex 20.59.12.0: Toners without a print head.

- ex 20.59.30.0: Ink cartridges without a print head.

- ex 28.23.26.0: Ink cartridges and toners with a print head.

- ex 22.21.30.0: Stretch-type foil.

- ex 26.11.30.0: Processors.

- 26.20.1: Computers and other automatic data processing machines.

- ex 26.20.21.0: Hard disk drives (HDD).

- ex 26.20.22.0: Solid-state drives (SSD).

- ex 26.30.22.0: Mobile phones, including smartphones.

- ex 26.40.60.0: Video game consoles.

- 26.70.13.0: Digital cameras and camcorders.

- Practical Application & Exclusions:

- Use GTU_06 for the sale of functional new or used electronic equipment listed in the regulations. Non-functional, scrapped electronics should be marked GTU_05.

- Do not use GTU_06 for repair services. The code does not apply to consumer electronics like televisions unless they explicitly fall under a specified PKWiU code.

GTU_07: Vehicles and Automotive Parts

- Description: Delivery of vehicles and automotive parts classified under CN codes 8701–8708.

- Scope and Key Examples (based on CN):

- CN 8701: Tractors.

- CN 8702: Public-transport type passenger motor vehicles.

- CN 8703: Motor cars and other motor vehicles principally designed for the transport of persons.

- CN 8704: Motor vehicles for the transport of goods.

- CN 8705: Special purpose motor vehicles (e.g., crane lorries, fire fighting vehicles, concrete-mixers).

- CN 8708: A wide range of parts including bumpers, brakes, gearboxes, axles, wheels, suspension systems, radiators, clutches, and steering wheels.

- Practical Application & Exclusions:

- Use GTU_07 when selling a car, tractor, or specific parts like a gearbox or bumper.

- Do not use GTU_07 for parts outside the specified CN codes, such as tires, glass, car seats, or engines. Repair and maintenance services are also excluded. The CN codes may change, hance it is suggested to check the part code before applying GTU codes.

GTU_08: Precious Metals and Stones

- Description: Delivery of precious and base metals, jewelry, and antiques, as specified in Annex 12 and certain items of Annex 15 to the VAT Act.

- Scope and Key Examples (based on PKWiU/CN):

- Annex 12: Unwrought or semi-finished gold, silver, and platinum.

- ex 32.12.13.0: Parts of jewelry made of precious metals.

- 7113: Articles of jewelry and parts thereof, of precious metal or of metal clad with precious metal.

- 7118: Coin.

- ex 9602: Amber products.

- Annex 15: Various rolled steel products, steel bars, and unwrought aluminum.

- Practical Application & Exclusions:

- Use GTU_08 when selling raw gold, silver jewelry, or specific steel products listed in the regulations.

- Do not use GTU_08 for finished goods made from these metals (e.g., steel screws) unless the product itself is listed. Jewelry not containing precious metals is excluded.

GTU_09: Pharmaceuticals and Medical Devices

- Description: Delivery of drugs, foodstuffs for special medical purposes, and medical devices that are included on the official list of products threatened with unavailability in Poland, as specified in the Pharmaceutical Law.

- Scope and Key Examples:

- This code’s application is dynamic and depends entirely on the list published by the Minister of Health.

- Practical Application & Exclusions:

- Use GTU_09 only if the specific product being sold is listed on the Minister of Health’s most recent public notice of “threatened” products at the time the tax obligation arises.

- Do not use GTU_09 for most common, over-the-counter medicines, supplements, or medical devices that are not on this specific, regulated list.

GTU_10: Buildings, Structures, and Land

- Description: Delivery of buildings, structures (budowle), and land.

- Scope and Key Examples:

- Sale of a commercial building, industrial hall, or warehouse.

- Sale of a plot of land.

- Sale of structures such as bridges, roads, or storage tanks.

- Sale of temporary structures that meet the legal definition of a “budowla,” such as kiosks or containers.

- Transfer of the right of perpetual usufruct of land.

- Practical Application & Exclusions:

- Use GTU_10 for transactions involving the transfer of ownership of the specified real estate.

- Do not use GTU_10 for the sale of individual apartment or office units (lokali).

- Do not use GTU_10 for rental, leasing, or construction services.

GTU_11: Greenhouse Gas Emission Allowances

- Description: Services related to the transfer of greenhouse gas emission allowances.

- Scope and Key Examples:

- Transactions involving the sale or transfer of emission allowances under the EU Emissions Trading System (EU ETS).

- Practical Application & Exclusions:

- Use GTU_11 when providing services that result in the transfer of these specific intangible rights. This code is highly specialized and applies only to entities participating in the emissions trading scheme.

GTU_12: Intangible and Advisory Services

- Description: Provision of intangible services, including advisory, accounting, legal, management, marketing, advertising, market research, R&D, and certain educational services.

- Scope and Key Examples (PKWiU for reference):

- 62.02: IT advisory services.

- 69.10: Legal services.

- 69.20: Accounting, bookkeeping, and financial audit services.

- 70.22: Business and management consulting services.

- 73.1: Advertising services.

- 73.2: Market research and public opinion polling services.

- 85.5: Other non-school forms of education.

- Practical Application & Exclusions:

- Use GTU_12 for invoicing services of a consultative, analytical, or creative nature as listed. The code covers comprehensive advertising or marketing campaign services (PKWiU 73.1).

- Do not use GTU_12 for certain related but distinct services. For example, the direct sale of advertising space in a newspaper (PKWiU 58.13.31.0) or on a website (PKWiU 63.11.20.0) is not covered by GTU_12.

GTU_13: Transport and Warehouse Management Services

- Description: Provision of transport and warehouse management services.

- Scope and Key Examples (based on PKWiU):

- ex 49.4: Road transport of goods.

- ex 52.1: Warehousing and storage of goods.

- Practical Application & Exclusions:

- Use GTU_13 when invoicing for freight transport or storage services.

- Do not use GTU_13 for ancillary services like postal and courier activities, or for passenger transport.

Careful classification based on the official regulations is paramount. After reviewing what must be marked, it is equally important to understand what is explicitly exempt.

4. GTU Exemptions and Common Exclusions

While the list of GTU categories is extensive, understanding when the codes do not apply is just as crucial for accurate JPK_V7 reporting. Certain documents and transaction types are explicitly excluded from the GTU marking obligation, which helps simplify compliance in specific scenarios.

When GTU Codes Are Not Required

- Purchase Transactions: To reiterate a key principle, the obligation to apply GTU codes rests solely on the seller. GTU codes are never marked in the purchase registry section of the JPK_V7 file.

- Collective Cash Register Reports (RO): Sales documented in the collective daily or monthly report from a fiscal cash register, marked with the document type “RO” in the JPK_V7, do not require individual GTU code marking. This was a significant clarifying change effective from July 1, 2021, simplifying reporting for retail businesses.

- Internal Documents (WEW): Transactions documented with an internal “WEW” document are also exempt from GTU marking requirements as of July 1, 2021. This typically applies to events like the non-remunerated transfer of goods that are treated as a taxable supply for VAT purposes.

- Specific Transaction Types: GTU codes are also not applied to transactions where the tax liability falls on the buyer. This includes:

- Reverse-charge transactions (both domestic and cross-border).

- Intra-Community acquisition of goods (WNT).

- Import of services.

Understanding these rules is the first line of defense against reporting errors. However, should a mistake occur, it is vital to know the potential consequences and the correct procedure for remediation.

5. Penalties and Corrections: Managing GTU Errors

The critical importance of accuracy in JPK_V7 reporting cannot be overstated. Because the evidentiary part is now treated as a formal “tax book” (księga), errors—including incorrect or missing GTU codes—can lead to significant financial and legal consequences under Polish law.

GTU Penalties: The Consequences of Non-Compliance

Errors related to GTU marking can trigger two main types of penalties, originating from different legal frameworks.

Administrative Fine An administrative penalty of 500 PLN can be imposed by the head of the tax office for each error found in the JPK_V7 file that prevents the verification of a transaction’s correctness. However, this fine is not automatic. It is only imposed if the taxpayer fails to submit a corrected JPK file or provide a satisfactory explanation demonstrating the absence of errors within 14 days of receiving a formal request from the tax office. Importantly, an individual cannot be penalized for the same act under both this administrative rule and the Fiscal Penal Code (KKS).

Fiscal Penal Code (KKS) Sanctions Incorrect GTU marking can also be classified as providing a faulty (“wadliwa”) or unreliable (“nierzetelna”) tax book under the Fiscal Penal Code. The potential penalty for such an offense is a fine of up to 240 daily rates (as per Article 61a of the KKS). For minor offenses (“czyny mniejszej wagi”), the penalty is a lower fine equivalent to that for a fiscal misdemeanor. It is crucial to note that liability under the KKS requires the tax authorities to prove intent (wina umyślna) on the part of the perpetrator.

How to Correct GTU Errors in a JPK File

The primary and required method for fixing any error in a previously submitted JPK_V7 file, including GTU mistakes, is to submit a formal correction of that file. The new submission replaces the incorrect version and should reflect the accurate data for the reporting period.

The Role of “ voluntary disclosure” (Czynny Żal) for VAT Errors

“Voluntary disclosure ” (czynny żal) is a formal notification submitted to the tax authorities under Article 16 of the Fiscal Penal Code. In this notification, a person voluntarily reports having committed a fiscal offense, outlines its circumstances, and rectifies the issue.

- Purpose: Its primary purpose is to avoid the penalties outlined in the Fiscal Penal Code. When correcting errors in the evidentiary part of the JPK_V7 (which includes GTU codes), filing an voluntary disclosure is a necessary step to protect against fiscal sanctions.

- Responsibility: The notification must be filed by the individual perpetrator (sprawca) of the offense. Depending on the company’s structure and contractual arrangements, this could be the business owner, a company board member, or even an employee of the accounting firm responsible for tax filings.

- Future Changes: The Ministry of Finance has signaled that it is considering legislative changes to remove the voluntary disclosure requirement for corrections made to the evidentiary part of the JPK file, which would align the rules with the more lenient procedures already in place for correcting tax declarations.

6. Broader Context:

GTU codes do not exist in a vacuum. They are a component of a wider ecosystem of digital tax compliance tools being implemented in Poland. Understanding their relationship with other mechanisms and their role in future reforms provides a complete picture of the compliance landscape.

Looking Ahead: The National System of e-Invoices (KSeF)

The National System of e-Invoices (Krajowy System e-Faktur, or KSeF) represents the next major evolution in Polish tax digitalization, set to become mandatory in 2026. This system will introduce structured, standardized e-invoicing for all B2B transactions.

GTU codes will remain relevant and integrated into this new system. The official e-invoice XML structure for KSeF, known as FA(2), and FA(3) when KSeF will go life, includes dedicated fields for marking GTU codes directly within the invoice data. This inclusion confirms the long-term strategic importance of GTU classification in the Polish tax authorities’ data analysis and control strategy, ensuring that this reporting requirement will continue for the foreseeable future.

Get support: Need help with mapping or a quick VAT audit in Poland? Contact our team: VAT in Poland guide, VAT deadlines, KSeF guide, E‑invoicing services.

FAQ

Do I have to show GTU on the invoice?

No. GTU is a register‑only label for JPK_V7. Keeping GTU on the PDF is optional.

Is the 500 PLN fine per error automatic?

No. It applies after a formal request if you neither correct nor prove there is no error within 14 days. More severe cases may trigger KKS liability.

How long do I have to correct an error found internally?

As a rule, correct without delay (statutorily within 14 days of identifying the error/changes in the register data).

Does GTU apply to advance invoices and credit notes?

Report GTU for sales items that fall into GTU groups; credit notes follow the original classification (do not invent new GTU).

How does KSeF change GTU?

KSeF does not replace GTU. It adds e‑invoice identifiers you should cross‑reference to your JPK_V7. Ensure master‑data alignment before the 2026 mandate.