In brief

The article discusses the introduction in Poland of the White List of VAT Taxpayers, officially known as the Register of entities registered as VAT taxpayers, as a key tool for tightening the tax system. The main purpose of this mechanism is to encourage entrepreneurs to exercise due diligence when selecting business partners and to combat the shadow economy, primarily by minimizing unintentional participation in carousel fraud. The list is a comprehensive and free verification system, available online and updated daily, which has replaced many previous registers. The consequences of failing to meet the requirement to make payments exceeding PLN 15,000 to accounts appearing on the list include the loss of the right to treat the expense as a tax-deductible cost and potential joint and several liability for VAT. Entrepreneurs can avoid these sanctions by using the split payment mechanism or by notifying the tax office of a transfer to an undisclosed account.

Objectives of the White List

Below are the objectives and assumptions of the White List, whose official name is the Register of entities registered as VAT taxpayers:

- Tightening the tax system—particularly in respect of value added tax (VAT).

- Preventing tax avoidance.

- Ensuring the stability of State Treasury revenues.

- Combating the shadow economy to increase budget revenues from tax liabilities.

- Reducing the risk of entrepreneurs’ participation in VAT carousel fraud.

- Increasing the safety and certainty of economic transactions.

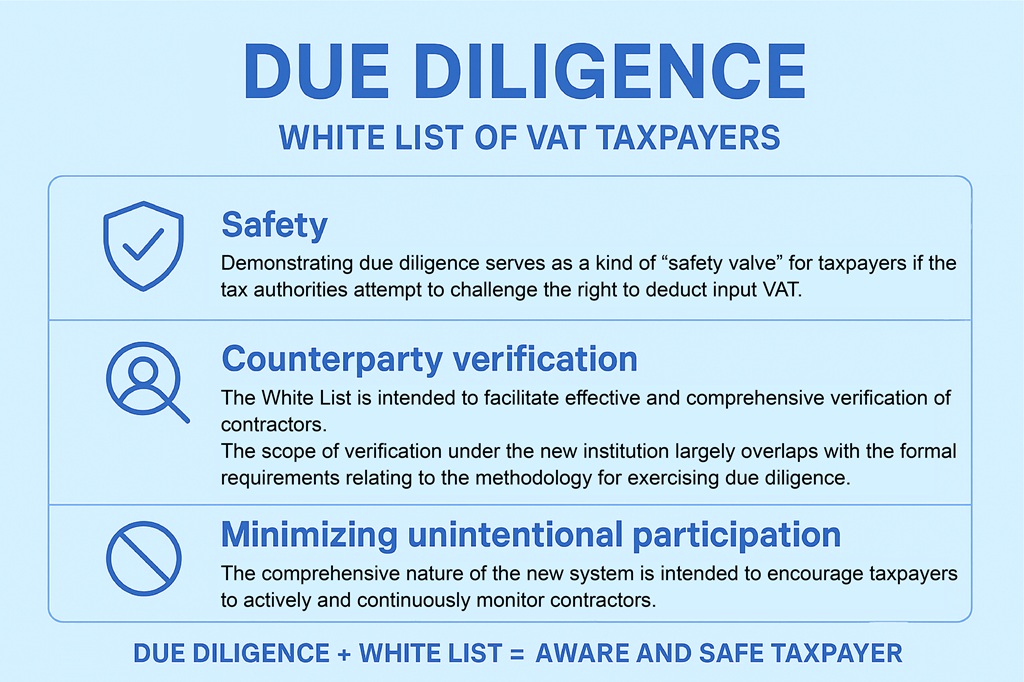

Main Premise: Due Diligence

The primary premise for introducing the White List is to encourage taxpayers to exercise due diligence when choosing their contractors.

- Safety: Demonstrating due diligence serves as a kind of “safety valve” for taxpayers if the tax authorities attempt to challenge the right to deduct input VAT.

- Counterparty verification: The White List is intended to facilitate effective and comprehensive verification of contractors. The scope of verification under the new institution largely overlaps with the formal requirements relating to the methodology for exercising due diligence.

- Minimizing unintentional participation: The comprehensive nature of the new system is intended to encourage taxpayers to actively and continuously monitor contractors, thereby reducing unintentional participation in carousel transactions.

Functional and Organizational Assumptions of the White List

- Creating a comprehensive contractor verification system by building an integrated information system on VAT taxpayers.

- Replacing existing registers with a single integrated system that enables the verification of a contractor’s data.

- Intuitive search by the taxpayer’s NIP (tax identification number) or by part of the verified entity’s name/surname.

- Availability and updates: The Register is available electronically on the website of the Ministry of Finance and the Central Registration and Information on Business (CEIDG), and access is completely free. The database is updated on an ongoing basis—once per business day.

- Determining current status: The list is intended to determine a taxpayer’s current status under VAT regulations and to include key, publicly available information related to the functioning of a business entity.

- Disciplinary mechanism (accounts): The main goal is to enforce that a taxpayer makes payments for goods and services only to a bank account listed in the VAT taxpayers register.

Thanks to these assumptions, taxpayers gained the ability to verify contractors as of a given day for a period of five years back, which aligns with the statute of limitations for tax liabilities.

Structure of the List

- name or first and last name,

- the number under which the entity is identified for VAT purposes,

- the status of an entity that was not registered or was removed from the register as a VAT taxpayer,

- the status of an entity registered as an “active VAT taxpayer” or a “VAT-exempt taxpayer,” including an entity whose registration has been restored,

- REGON statistical number,

- National Court Register (KRS) number,

- registered office address—for an entity that is not a natural person,

- address of the fixed place of business or residential address if no fixed place of business—for a natural person,

- first and last names of persons authorized to represent the business entity and their tax identification numbers,

- first and last names of proxies and their tax identification numbers,

- the first and last name or the name of a partner and that partner’s tax identification number,

- dates of registration, refusal of registration, removal from the register, and restoration of registration as a VAT taxpayer,

- legal basis for refusal of registration, removal from the register, and restoration of registration as a VAT taxpayer,

- legal basis for exemption—for taxpayers referred to in Article 113a(1) of the VAT Act, registered as EU VAT taxpayers,

- bank account numbers.

Due Diligence and the White List Mechanism

The introduction of the White List of VAT Taxpayers entails additional obligations for businesses and, consequently, the risk of tax sanctions where due diligence is not exercised—especially regarding payments to bank accounts.

The main tax consequences for making a payment to an account not disclosed on the White List concern transactions whose value exceeds PLN 15,000.

- Loss of the right to treat the expense as a tax-deductible cost (KUP).

- Joint and several liability for VAT. This means that if the contractor (seller/service provider) fails to pay the VAT due, and the purchaser made a transfer to a bank account not appearing on the White List, the purchaser becomes jointly and severally liable together with the seller.

The primary purpose of the joint and several liability institution is to enforce that the taxpayer makes payments for goods and services only to accounts included in the VAT taxpayers register.

Ways to Avoid Sanctions

An entrepreneur can avoid both joint and several liability and the sanction of losing the ability to recognize the expense as a tax-deductible cost by using the following mechanisms:

- Notifying the head of the tax office about having ordered a transfer to a bank account not disclosed on the White List.

- Using the Split Payment Mechanism (MPP). Payment under split payment protects the state budget against the risk that the supplier will fail to remit VAT, which justifies avoiding joint and several liability.

Impact of the White List on Due Diligence

The introduction of the White List of VAT Taxpayers had a key and direct impact on entrepreneurs’ exercise of due diligence, making this process easier, more comprehensive, and better defined—which was the main premise for creating the register.

- Facilitating and systematizing verification. The White List was introduced as a comprehensive system for verifying contractors, intended to make verification efficient and thorough. Before the White List, reliable contractor verification required checking multiple source registers (e.g., KRS, CEIDG, lists of removed taxpayers, lists of active taxpayers). Replacing these lists with a single integrated system significantly speeds up data verification and covers key formal criteria like VAT status, registration identifiers, and settlement account numbers.

- Acting as a “safety valve”: Exercising due diligence serves as a “safety valve” for taxpayers if the tax authorities attempt to challenge the right to deduct input tax. Documenting contractor verification using the White List is a key element of demonstrating such diligence and reduces interpretative ambiguity.

- Preventing unintentional involvement in crime: The system encourages active, ongoing monitoring of contractors to reduce the risk of carousel fraud participation, increase transactional certainty, and help avoid sanctions.

- Consistency with the limitation period: The White List enables verification of contractors as of a given day up to five years back, aligning with the statute of limitations for tax liabilities.

Data Updates

The data included in the White List of VAT Taxpayers is updated on an ongoing basis—once per business day. This includes the bank account numbers. If the register is not updated in time, a taxpayer who orders a transfer on the same day as verification should not suffer negative consequences. Information is available for the five years preceding the year of inquiry, which aligns with the statute of limitations.

Q&A: White List of VAT Taxpayers (Poland)

Q1: What is the VAT White List?

A: It’s a register of entities registered as VAT taxpayers (active or exempt), used to verify counterparties and reduce the risk of involvement in fraud (e.g., VAT carousel schemes). It’s free and available online.

Q2: What is the main purpose of the White List?

A: To tighten the tax system, increase transaction security, support due diligence when selecting counterparties, and encourage payments to reported business bank accounts.

Q3: How does the White List support due diligence?

A: It enables quick, comprehensive checks of a counterparty in one place (VAT status, identifiers, bank accounts), helping demonstrate due diligence for VAT deduction and reducing the risk of unwitting participation in abuses.

Q4: What data does the register contain?

A: Among others: name/full name, NIP (tax ID), VAT status (active/exempt/removed/reinstated), REGON, KRS, addresses, persons authorized to represent the company and their NIP, proxies, partners/shareholders, registration dates, and bank account numbers.

Q6: How often is the data updated?

A: The database is updated on an ongoing basis—once on each business day. You can check the status for any day up to 5 years back (aligned with the statute of limitations for tax liabilities).

Q7: How long is historical information available?

A: You can review data up to 5 years back from the year of the query, corresponding to the statute of limitations for tax liabilities.

Summary

The White List of VAT Taxpayers supports key goals of Poland’s tax policy by preventing tax avoidance and combating the shadow economy. It encourages due diligence in contractor selection and minimizes unintentional involvement in tax fraud. A core objective is ensuring payments for goods and services are made only to bank accounts included in the VAT taxpayers register.

Need Expert Support?

Contact us at office@intertax.pl