This News article consolidates the current standard VAT rates and the main reduced bands across all EU Member States. The EU framework requires a minimum standard rate of 15%, while Member States define their exact rates and eligible reduced-rate categories. Always verify category eligibility in the linked official sources before applying a reduced or zero rate.

EU framework for VAT rates

- Standard rate: must not be lower than 15% (per Directive). There is no upper ceiling, but historically rates have stayed between 15% and 27%.

- Reduced rates: Member States may apply one or two reduced rates of not less than 5%, but only to supplies listed in Annex III to the Directive (e.g., food, books, medicines, cultural admissions).

- Super-reduced rates: Below 5% or even 0% are permitted in certain Member States under derogations negotiated when they joined the EU.

- Zero rates: In practice, certain supplies (e.g., intra-EU or international transport, newspapers in Ireland, books in the UK pre-Brexit) may benefit from historical zero rates.

The political direction in recent years has been to allow more flexibility, especially for environmental and digital services, while ensuring fair competition across the internal market.

Important notes

- Category dependency: Reduced and zero rates are strictly tied to product or service categories. Eligibility must always be confirmed in the official documentation.

- Local variations: Certain Member States have specific regional regimes (e.g., Madeira and Azores in Portugal, Canary Islands in Spain).

- Denmark exception: Denmark applies only a single standard VAT rate (25%) without general reduced bands – one of the most rigid systems in the EU.

- Temporary measures: Several countries have occasionally reduced VAT to cushion inflation or energy shocks (e.g., Germany in 2020 pandemic, Poland in 2022 on energy/food). Businesses must therefore stay alert to sudden changes.

What is typically covered by reduced rates (Annex III snapshot)

- Foodstuffs and certain agricultural inputs; supply of water.

- Pharmaceutical products; medical equipment and aids (incl. items for persons with disabilities).

- Passenger transport and related services; bicycles (incl. e-bikes) and their repair/rental.

- Books, newspapers and periodicals — print and digital; certain non-profit publications.

- Admission to cultural events (theatres, concerts, museums, cinemas) and live-streaming; writers/composers’ royalties.

- Housing and social policy: construction and renovation of housing (incl. social housing); certain public-interest buildings; window cleaning in private households.

- Supply & installation of solar panels on/adjacent to housing and public-interest buildings.

- Hotel/accommodation services; restaurant and catering services (Member States may exclude beverages).

- Sport: admission to sporting events; use of sports facilities and classes.

- Welfare/social services by recognised organisations; funeral services; medical and dental care where not otherwise exempt.

- Municipal services: sewage, street cleaning, refuse collection, waste treatment and recycling.

- Repair services for household appliances, shoes and leather goods, clothing and household linen; domestic care services.

- Hairdressing.

- Energy and green transition: electricity, district heating/cooling, qualifying biogas and high‑efficiency low‑emission heating systems; until 1 Jan 2030, natural gas and firewood.

- Live plants and ornamental foliage; children’s clothing/footwear and car seats; works of art, collectors’ items and antiques.

- Legal aid services; specific rescue/first‑aid equipment supplied to public bodies/non‑profits; services connected with lightships/lighthouses and lifeboat operations.

EU-27 VAT rate table (standard + headline reduced)

Visuals

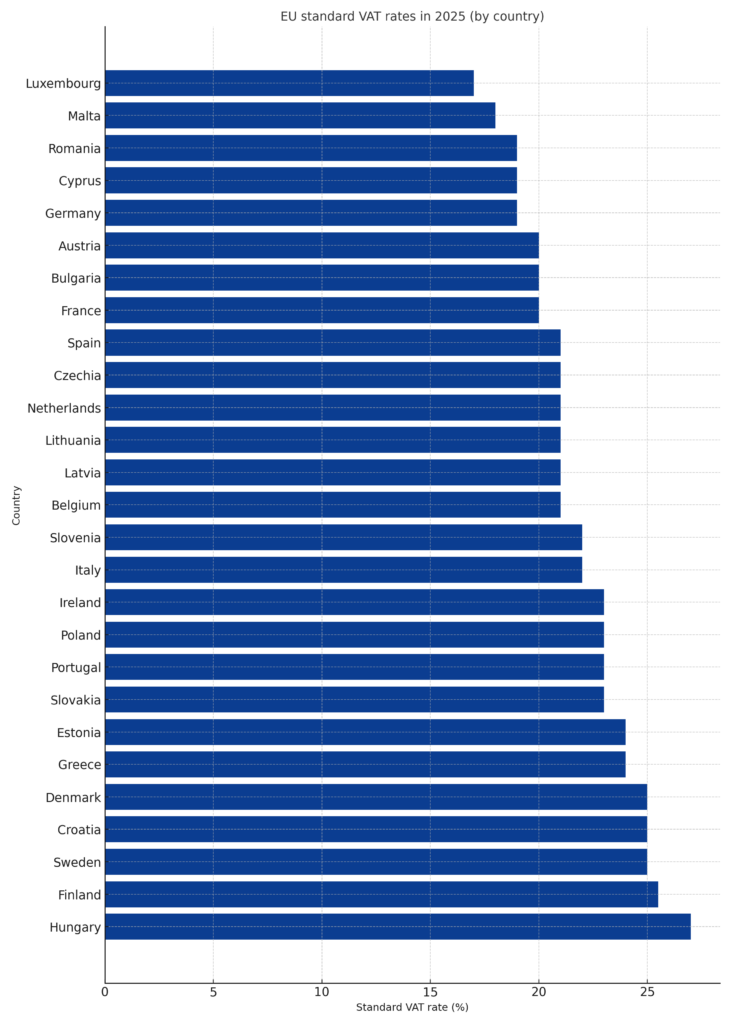

Standard VAT rates by country (sorted):

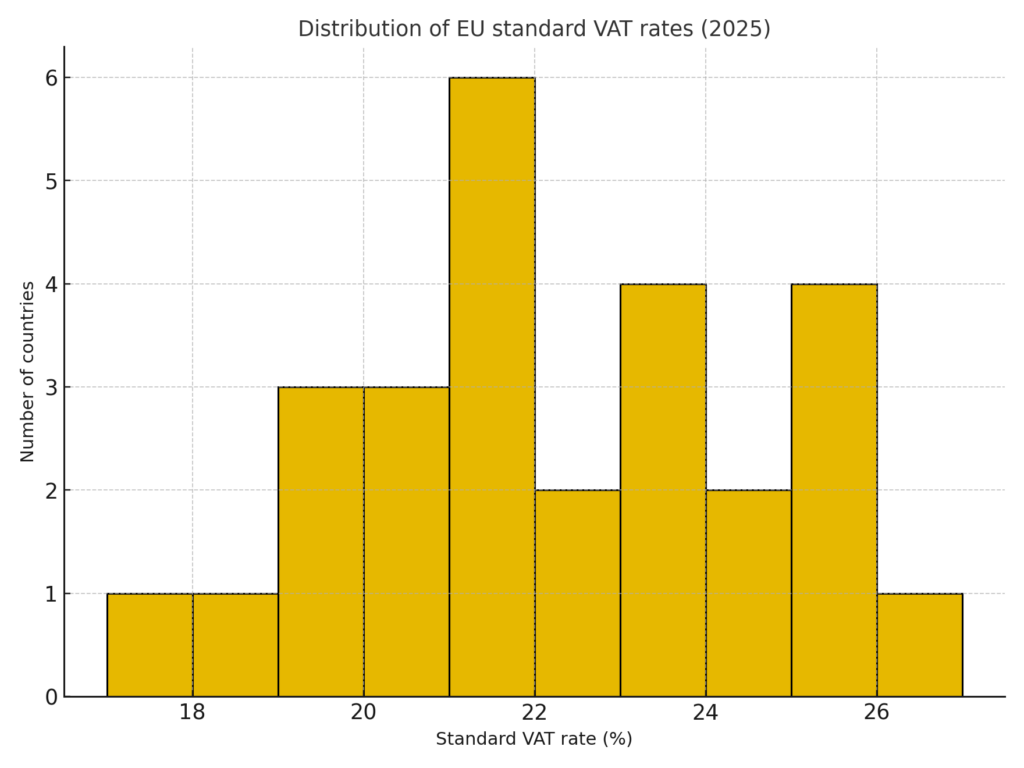

Distribution of standard VAT rates across the EU:

EU framework

European Commission – VAT rates overview: https://taxation-customs.ec.europa.eu/taxation/vat/vat-directive/vat-rates_en

Member State details: see the official tax authority pages linked per country in the table above.

Legal disclaimer

This material is provided for general guidance only and does not constitute tax advice. Rates and classifications change frequently. Always consult the official sources and seek professional advice tailored to your transactions.

How INTERTAX can help

Need validation of VAT rates and product/service mapping across the EU?

Our team provides rapid eligibility checks, invoicing guidance, and ongoing compliance monitoring (OSS/IOSS, SAF-T/JPK, e-invoicing).