Poland has implemented detailed VAT regulations regarding the transfer of to Poland under a call-off stock arrangement. For many international businesses, this mechanism provides an opportunity to simplify VAT compliance and avoid unnecessary tax burdens including VAT registration. However, navigating the Polish VAT system can be complex, especially when dealing with intra-community transfers, reporting obligations, and VAT refunds. This guide explains the essentials of VAT registration, compliance, and reporting requirements for taxpayers engaging in call-off stock transactions in Poland.

What you will learn from this article

- When VAT registration is required in Poland under the call-off stock procedure

- How the call-off stock arrangement works under the Polish VAT Act

- VAT compliance obligations, including VAT return filing and reporting deadlines

- Key benefits and risks of using call-off stock in Poland

- VAT refunds, exemptions, and interaction with the split payment mechanism

- Practical guidance on cooperation with Polish tax authorities and appointing a representative in Poland

VAT Registration in Poland under Call-Off Stock Procedure

Businesses transferring goods from another EU Member State to Poland under a call-off stock arrangement may, under certain conditions, avoid VAT registration in Poland. Instead, the taxable event arises only when the goods are taken from the warehouse by the Polish customer. This mechanism was introduced to align Polish VAT law with EU harmonization efforts and reduce the administrative burden for cross-border suppliers.

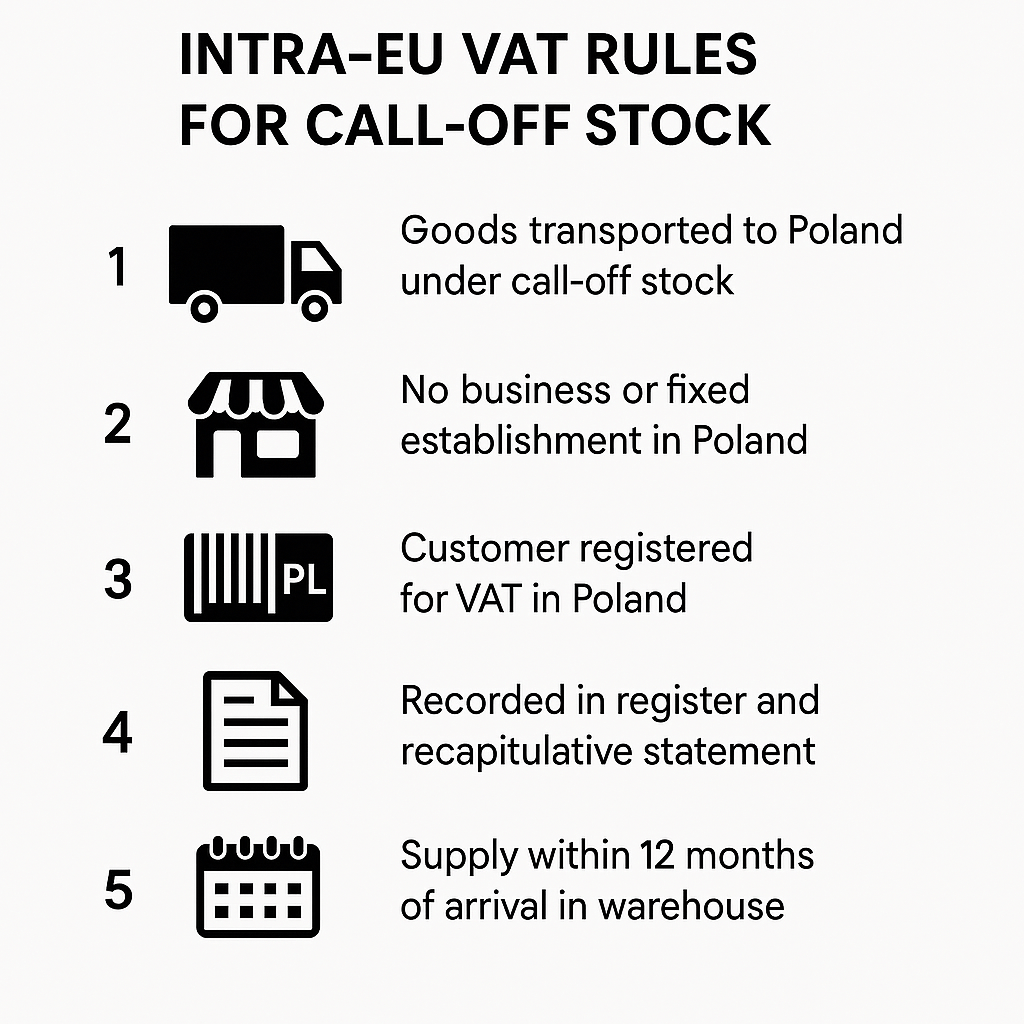

The call-off stock procedure applies if all of the following conditions are met:

- The goods are dispatched or transported by a value added tax (VAT) taxpayer, or by a third party acting on their behalf, from the territory of a Member State other than the domestic territory into the domestic territory, for the purpose of their subsequent supply, and after their introduction into the warehouse under the call-off stock procedure, to another taxpayer entitled to acquire the right to dispose of those goods as owner, in accordance with a prior agreement concluded between those taxpayers;

- The VAT taxpayer dispatching or transporting the goods does not have a place of business or a fixed establishment in Poland;

- The taxpayer to whom the goods are to be supplied is registered as an EU VAT taxpayer, and their name and tax identification number prefixed with the code “PL” are known to the VAT taxpayer dispatching or transporting the goods at the time the dispatch or transport begins;

- The VAT taxpayer dispatching or transporting the goods records the movement of the goods in the register and indicates in the EC sales list the tax identification number referred to in point 3.

If the conditions set out in the VAT provisions are fulfilled, the intra-Community acquisition of goods shall be deemed to have been made by the taxpayer referred to in Article 13a(2)(3) in Poland at the time when the right to dispose of the goods as owner is transferred to them, provided that such transfer occurs within 12 months from the date the goods were introduced into the warehouse under the call-off stock procedure.

Taking that into account, the suppliers must closely follow the requirements of the Polish VAT Act to remain compliant. These include maintaining proper documentation, recording movements of goods, and ensuring that customers are registered as VAT taxpayers in Poland. Failure to comply can result in the obligation to register for VAT, pay VAT in Poland, and submit periodic VAT returns.

VAT Compliance, Reporting, and VAT Returns

Even if VAT registration can be avoided, businesses must ensure that their intra-community transfers are properly reported both in Poland and in the Member State of dispatch. This includes the submission of recapitulative statements, updating VAT ledgers, and verifying VAT numbers of Polish customers. If registration becomes necessary, companies must file monthly or quarterly VAT returns, depending on their activities, and pay VAT due on time to the designated tax office in Poland.

The split payment mechanism, widely applied in Poland, may also affect settlements. Businesses operating under the call-off stock procedure should be prepared to adapt their payment processes accordingly. Input VAT refunds can be claimed within the deadlines provided by Polish VAT regulations, provided that all compliance conditions are met.

Benefits and Risks of Call-Off Stock Arrangement in Poland

The main advantage of the call-off stock procedure is simplification – suppliers avoid having to register for VAT immediately upon moving goods into Poland. This allows them to keep their operations more flexible and reduce VAT liabilities until the actual supply takes place. Additionally, businesses may optimize cash flow by deferring VAT obligations.

However, there are risks. Failure to comply with the Polish VAT Act may result in penalties, unexpected registration requirements, and denial of VAT refunds. Moreover, any change in the intended customer or non-compliance with documentation rules may immediately trigger a taxable event, requiring VAT settlement in Poland.

Practical Guidance for Taxpayers

Taxpayers engaging in call-off stock arrangements should establish robust VAT compliance processes.

This includes:

- Regularly verifying the VAT status of their Polish customers

- Keeping precise records of goods moved into Poland

- Consulting with tax advisors experienced in Polish VAT law

- Considering appointment of a VAT representative in Poland, especially when not established in the country

- Monitoring deadlines for VAT refunds and reporting obligations

FAQ – Frequently Asked Questions

1. Do I always need to register for VAT in Poland under the call-off stock arrangement?

No. If the conditions of the call-off stock procedure are met, suppliers may avoid immediate VAT registration in Poland. VAT becomes due only when the goods are withdrawn by the Polish customer.

2. What happens if the goods are not collected by the Polish customer?

If the goods remain in Poland beyond the permitted time limit (usually 12 months), the transfer may be deemed an intra-community acquisition in Poland, triggering VAT obligations and the need to register.

3. Can I recover input VAT in Poland if I am not registered?

Yes, but only under specific refund procedures available for non-established businesses. Otherwise, registration may be required to recover input VAT on costs incurred in Poland.

4. Is a VAT representative mandatory in Poland?

Non-EU businesses must appoint a VAT representative in Poland. This obligation does not apply to companies from the United Kingdom (UK) and Norway. EU-established businesses generally do not need a representative, although having one can simplify VAT compliance and communication with Polish tax authorities.

5. How does the split payment mechanism affect call-off stock transactions?

The split payment mechanism may apply when Polish customers settle invoices. This requires that VAT amounts are paid into a dedicated VAT bank account, ensuring that VAT liabilities are properly covered.

You can find information about call-off stock warehouse here : https://www.podatki.gov.pl/vat/wyjasnienia/zawiadomienie-o-prowadzeniu-magazynu-typu-call-off-stock/

Contact us about our VAT Consulting services