The place of supply of services determines where VAT is due, who accounts for it, and whether you must register for VAT in another country. For B2B, the general rule points to the customer’s location; for B2C, to the supplier’s location. Numerous special rules override these defaults—for example, services relating to land, transport, event admissions, restaurant and catering services, or electronically supplied services. Getting this wrong affects VAT rate, invoicing, reverse charge, and compliance exposure.

Legal framework (EU & Poland): rules for the place of supply

Core sources are the EU VAT Directive 2006/112/EC (esp. Arts 44–59b) and the Implementing Regulation (EU) No 282/2011 (definitions and clarifications), complemented by Implementing Regulation (EU) No 1042/2013 (amendments incl. immovable property/TBE). In Poland these are transposed by the VAT Act – consolidated text (Dz.U. 2024 poz. 361) (Arts 28a–28o).

General place of supply rules

- B2B general rule (place of supply rule). The place of supply is where the recipient (customer) is established or has the FE receiving the service. Typically, the reverse charge applies there.

- B2C general rule. The place of supply is where the supplier is established (exceptions apply).

- Practical evidence. VAT ID/VIES checks, contracts, billing address, IP/geo data, delivery terms, and proof that a service is supplied to a given FE.

Decision tree: determine the place for services supplied

- Identify B2B or B2C;

- Check whether a special rule applies;

- If multiple establishments exist, decide whether a fixed establishment is actually involved;

- Consider any use and enjoyment rules;

- Confirm who accounts for VAT (reverse charge/local VAT);

- Document evidence and invoice accordingly.

Special rules: service-by-service overview

- Services relating to land (services connected with immovable property).Place = property location (B2B and B2C). Includes experts/estate agents, accommodation, construction, architecture.

- Transport services.

- Passenger: generally where transport takes place, proportionate to distance.

- Freight and associated services: rules vary by B2B/B2C and route; check whether general B2B rule or specific allocation applies.

- Admission to events & ancillary services.Place where the event takes place (e.g., trade fairs, cultural, educational events).

- Restaurant and catering services.Place where physically carried out; catering on board transport has special allocation.

- Hiring of means of transport.Short‑term: where the vehicle is put at the customer’s disposal; long‑term B2C: generally customer’s location; B2B: general rule.

- Work on movable property; valuations; ancillary services. Often where physically carried out for B2C; B2B may follow the general rule.

- Intermediary services. If acting in the name and on behalf of another, place often follows the underlying supply; otherwise apply general rules.

- Telecom, broadcasting and electronically supplied services (TBE).B2C: generally customer’s location, with OSS available; B2B: general rule (customer location).

Use and enjoyment rules

Member States may shift the place of supply to the place of actual consumption for certain specific services to prevent double taxation/non-taxation. Poland applies limited use‑and‑enjoyment adjustments; always verify for TBE, transport, or hiring of means of transport. Keep contractual place, actual use, and user evidence aligned.

Fixed establishment (FE)

An FE requires sufficient human and technical resources to receive and use services for its own needs. Where an FE is genuinely involved in a supply, the place of supply for services may shift to that FE’s location. Risk flags: personnel dedicated to the service (outsourced personel counts as well), infrastructure, decision‑making, local contracts/invoicing, and ongoing ability to receive the services independently of the head office.

Platforms, agency and intermediary services

Distinguish intermediaries acting in another’s name (place can track the underlying supply) from deemed supplier models in the digital economy. Platform roles impact who accounts for VAT, reverse charge, OSS/IOSS eligibility, and whether the supply is where the supplier or the recipient is established.

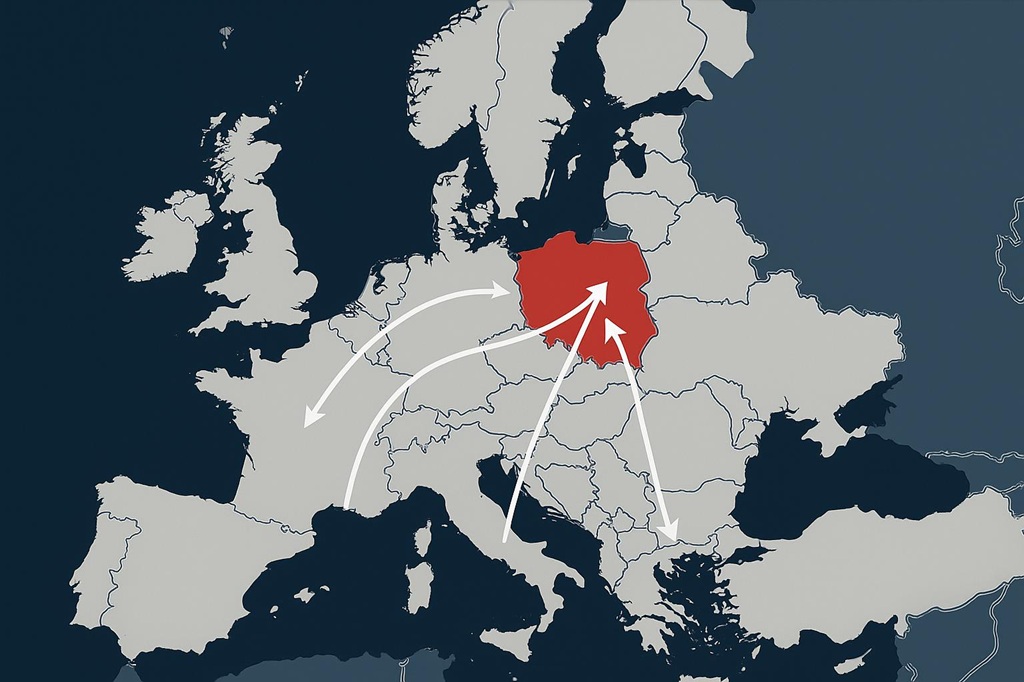

Poland-specific practice & compliance

- Reverse charge in Poland (B2B inbound). Imported services are reported by Polish recipients when the place of supply is in Poland.

- Register for VAT. Consider foreign VAT registration if a special rule localizes the supply abroad or use and enjoyment applies.

- Invoicing & KSeF. Ensure correct VAT rate/notation (e.g., reverse charge), accurate buyer VAT ID, and JPK_V7 mapping.

- Evidence pack. Contracts, order forms, service delivery logs, IP/geo proofs for electronically supplied services, and property location evidence for services relating to land.

Examples

- B2B consultancy (PL → DE). Customer is a German VAT payer; place of supply = Germany; supplier issues reverse charge invoice; no Polish output VAT.

- Online training B2C (PL → FR).Electronically supplied service to French consumers; place = France; report via OSS or French VAT reporting.

- B2B Architect services for property in Poland (non‑resident client).Place of supply = Poland (immovable property); Polish VAT due; consider Polish registration if supplier has no FE.

- Equipment rental to consumers.Short‑term: where placed at disposal; long‑term: generally customer’s location (B2C).

- Event admission in Italy sold by a Polish supplier.Place = Italy; Italian VAT; ticketing system must apply local rate.

Common pitfalls

- Treating FE as present without real resources or involvement or assuming there’s no FE in a local country while local real resources or involvement exists. Always analyse the possibility of having local FE or preferable apply for a local ruling.

- Misclassifying intermediary services or composite supplies.

- Ignoring use and enjoyment rules or event location.

- Missing OSS for B2C digital services; applying wrong VAT rate.

Compliance checklist

- Classify the service supplied and B2B/B2C status.

- Test special rules (land, transport, event admission, restaurant and catering services, hiring vehicles, TBE, intermediaries).

- Assess fixed establishment involvement.

- Consider use and enjoyment.

- Decide who accounts for VAT (reverse charge vs local VAT) and whether to register for VAT abroad / use OSS.

- Assemble evidence (VIES, contracts, IP/location, property docs).

- Invoice & report (KSeF-ready, JPK_V7, VAT return).

Conclusion

Correctly identifying the place of supply is the place where VAT is due safeguards rates, reporting, and risk. If your group operates across borders—IT/SSC, marketplaces, professional services—build a place-of-supply matrix for your service catalogue and maintain a robust evidence pack.

Need a rapid treatment‑check or FE assessment? Our VAT team can help you map supplies, determine the place, and implement OSS/registrations.

Authoritative sources & further reading

- EU law: EU VAT Directive 2006/112/EC (EUR‑Lex); Implementing Regulation (EU) No 282/2011 (EUR‑Lex); Implementing Regulation (EU) No 1042/2013 (EUR‑Lex)

- European Commission guidance: Place of taxation of services; Explanatory Notes – services connected with immovable property (PDF); Commission guidelines on VAT (hub)

- Poland – legislation & administration: Ustawa o VAT – tekst jednolity (Dz.U. 2024 poz. 361, pdf); Biznes.gov.pl: VAT w handlu międzynarodowym – miejsce świadczenia usług;

- Tools: VIES – VAT number validation;

Read more about our VAT Consulting Services