Executive Summary

Fiscal Representative in Poland Non-EU companies (e.g., USA, China) must appoint a fiscal representative to register for VAT in Poland, unless they are established in the UK or Norway. Unlike a standard tax agent, the representative bears joint and several liability for the company’s VAT debts, which necessitates strict verification (KYC) and often financial guarantees. Their duties include handling the entire compliance process, from VAT registration and monthly JPK_V7 reporting to representing the entity before Polish tax authorities.

Foreign businesses expanding into Poland often start with a simple question: “Can we just register for Polish VAT?” The answer depends heavily on where the company is established and how it will operate in Poland—especially if it imports goods, warehouses stock (e.g., Amazon FBA), or sells cross-border to Polish customers.

In practice, there are three common scenarios:

- EU companies registering for Polish VAT. A tax representative is not required, but most often they use the services of a professional authorized tax agent to handle filings and communication (optional, but helpful).

- Non-EU companies (e.g., USA, Switzerland, China, Argentina, Hong Kong, Singapore, Canada) that must appoint a fiscal representative in Poland before VAT registration is possible. Norway and the United Kingdom are exempt from this obligation.

Below is a clear, practical guide to the rules, the compliance workload, and (crucially) the risk profile carried by the fiscal representative.

Fiscal Representative in Poland definition

A fiscal representative (often described in English as a “VAT fiscal representative” or “tax representative”) is a Poland-based entity that acts on behalf of a foreign taxpayer in Polish VAT matters, especially where the taxpayer is not established in the EU and performs activities taxable in Poland.

In Polish VAT law, the obligation to appoint a representative is linked to Article 18a of the Polish VAT Act (commonly referenced in guidance and commentary on this topic).

Mandatory fiscal representation Poland

As a general rule, a business established outside the EU that needs to register for Polish VAT may be required to do so via a fiscal representative, particularly if it will carry out taxable transactions in Poland without an EU establishment.

This is why non-EU businesses expanding supply chains into Poland – especially importers and warehousing models – must plan fiscal representation early, before starting operations. This also applies to Amazon FBA

When is a fiscal representative required?

A fiscal representative is typically required when a non-EU entity becomes a non-resident taxable person in Poland and must register for VAT (e.g., to charge Polish VAT, report imports, or claim deductions).

Common real-world triggers include:

- Import of goods to Poland followed by local sales or B2B supplies (import + onward supply chain).

- Warehousing goods in Poland (including Amazon FBA sellers in Poland using Polish fulfillment).

- Cross-border supply chain models where title to goods changes in Poland.

- Certain distance selling rules scenarios where registration becomes necessary (depending on structure and thresholds).

Where import is involved, the company must also deal with the customs declaration and the customs clearance procedure (typically via electronic systems; Poland points traders to PUESC and instructions for AIS/IMPORT, etc.).

Non-EU companies VAT Poland

For a non-EU company, “VAT registration” is not just a VAT id number, it is an ongoing compliance system. Typically, the process includes:

- Obtaining a Polish tax identification number (NIP) and completing foreign entity registration steps. NIP is a tax identifier used by Polish tax administration to identify a taxpayer.

- VAT-R form submission to register for VAT purposes.

- Ongoing reporting: monthly VAT returns and SAF-T files reporting in the JPK_V7 structure.

Poland’s official guidance confirms that Standard Audit File for Tax (JPK_VAT) with declaration is filed electronically and (as a rule) covers monthly periods, submitted by the 25th day of the month for the previous month.

This is where many non-EU businesses underestimate the workload. VAT in Poland is strongly data-driven, and the standard audit file (SAF-T / JPK) format requires accurate transactional mapping, not just totals.

Fiscal representative vs tax agent

This distinction matters:

- A tax agent / authorized tax agent (often used by EU companies) is primarily a service provider: prepares registrations, submits returns, communicates with the tax office, helps with audits, but does not automatically take on the same statutory liability as a fiscal representative.

- A fiscal representative is a formal institution under VAT rules for non-EU entities and is commonly described as carrying additional responsibility tied to the taxpayer’s VAT obligations.

So, an EU business may choose professional support and a non-EU business may be legally required to appoint a fiscal representative before it can register and operate compliantly.

Joint and several liability

So a fiscal representative not only represents the non-EU taxpayer, but can also be jointly and severally liable for VAT liabilities settled on that taxpayer’s behalf.

This drives strict onboarding (KYC), continuous monitoring, and careful contractual frameworks—because the fiscal representative is effectively exposed if the non-EU business becomes non-compliant or insolvent. During the KYC procedure financial institutions, confirm a customer’s identity to prevent fraud, money laundering, and terrorist financing, ensuring they are who they claim to be by collecting and verifying personal data like ID documents (passports, driver’s licenses) and proof of address. It’s a crucial part of Anti-Money Laundering (AML) regulations, protecting companies and maintaining financial system integrity through identity verification, customer due diligence, and ongoing monitoring.

Appointment of a tax representative

In practice, appointment involves a written agreement with representative and a strong verification process, typically including:

- Solvency check and ownership review of the non-EU entity,

- Validation of the supply chain and transaction flows (import, warehousing, domestic sales),

- Controls around invoicing, VAT rates, and documentation (especially for imports and exports),

- Sometimes additional risk mitigation (e.g., security deposit requirement or bank guarantee) depending on the profile of operations and the fiscal risk approach. The type and size of the setup is determined for each client and is not always the same when negotiating the terms of the agreement appointing a tax representative.

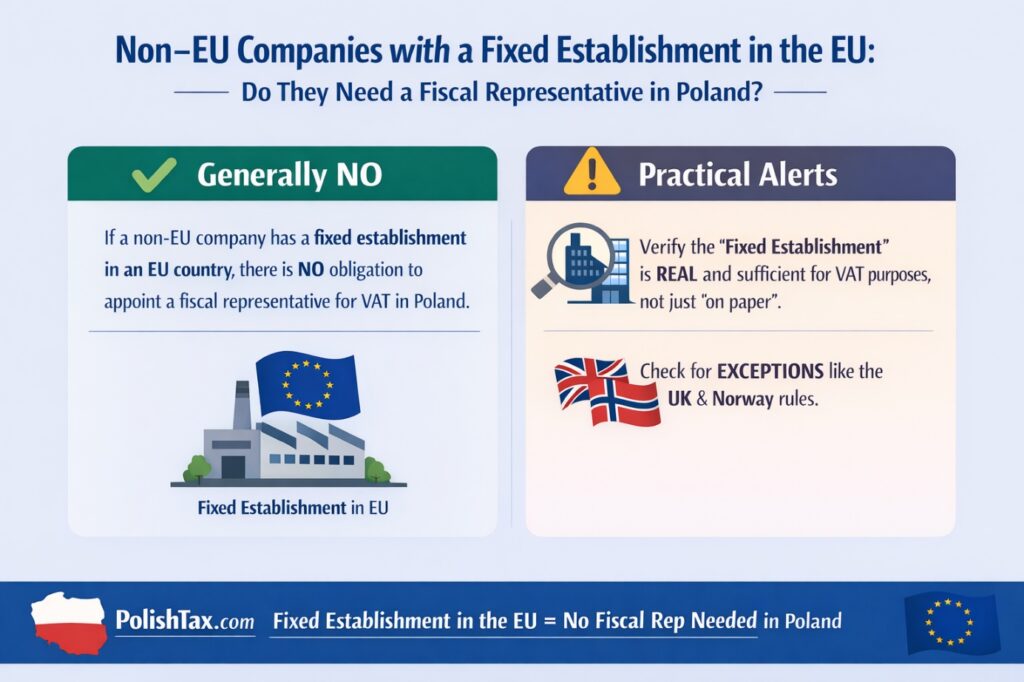

Exemptions from fiscal representation

Poland introduced an important exception: businesses established in Norway and the United Kingdom are exempt from the obligation to appoint a fiscal representative under the relevant regulation published in 2021. Also, if a non-EU company has a fixed establishment in the territory of an EU Member State, there is no obligation in Poland to appoint a tax representative for VAT purposes.

This is a major operational difference compared to companies from USA, Switzerland, China, Argentina, Hong Kong, Singapore or Canada which usually cannot rely on that exemption.

UK companies and Polish VAT post-Brexit

Post-Brexit, UK businesses are non-EU for VAT structuring purposes—but in Poland they may still fall under the exemption from mandatory fiscal representation referenced above.

Practically: UK companies may register for Polish VAT without appointing a fiscal representative, but they still face the same compliance burden (JPK_V7, deadlines, audit readiness) once registered.

Polish VAT registration for non-EU entities

For non-EU entities, VAT registration is often tightly linked with operational steps such as:

- Import of goods to Poland and related VAT settlement,

- Correct handling of the customs process (documentation, declarations, classification),

- Ensuring tax office credibility and traceability of payments and counterparties.

If your Polish counterparties ask you to confirm VAT status, Polish Ministry of Finance provides the White List of VAT payers used to verify VAT registration data.

Duties of a fiscal representative

A fiscal representative’s day-to-day responsibilities typically include:

- Handling VAT registration and communication with the tax office,

- Preparing and submitting JPK_V7 files (monthly or quarterly structures, depending on eligibility),

- Supporting standard audit file compliance and audit queries,

- Overseeing VAT documentation for imports (invoices, customs documents),

- Supporting VAT refund procedure where applicable (or ensuring the taxpayer can deduct input VAT correctly through returns).

Poland’s official guidance emphasizes the JPK_V7 filing framework and deadlines (25th of the month, electronic filing, structured reporting).

Consequences of not appointing a fiscal representative

If a non-EU business that is required to appoint a fiscal representative does not do so, the practical consequences can include:

- Inability to complete VAT registration properly (and therefore inability to invoice/operate as planned),

- Disruption to import/warehousing operations (especially where VAT registration is needed for downstream sales),

- Accumulating compliance exposure (late filings, incorrect reporting, missing JPK submissions).

Poland’s public guidance also describes VAT obligations and the importance of correct registration and record-keeping.

VAT compliance for third-country businesses

For third-country businesses, “compliance” is usually a bundle:

- Registration (VAT-R),

- Regular structured reporting (JPK_V7 / SAF-T),

- Accurate transaction mapping (sales, purchases, imports),

- Audit readiness and documentation discipline,

- Counterparty verification (often including checks against the White List).

If your model involves importing goods from outside the EU, our VAT Consultants will provide you with guidelines on settling import VAT and present the available procedures (including, in some cases, the possibility of using simplified methods).

Final takeaway

If your company is established in the EU, Polish VAT registration is usually straightforward—and using a tax agent is a choice. If you are a non-EU entity (USA, Switzerland, China, Argentina, Hong Kong, Singapore, Canada), you should assume early on that mandatory appointment of fiscal rep may apply, and plan the project with the compliance burden and the fiscal representative’s risk profile in mind.