In brief

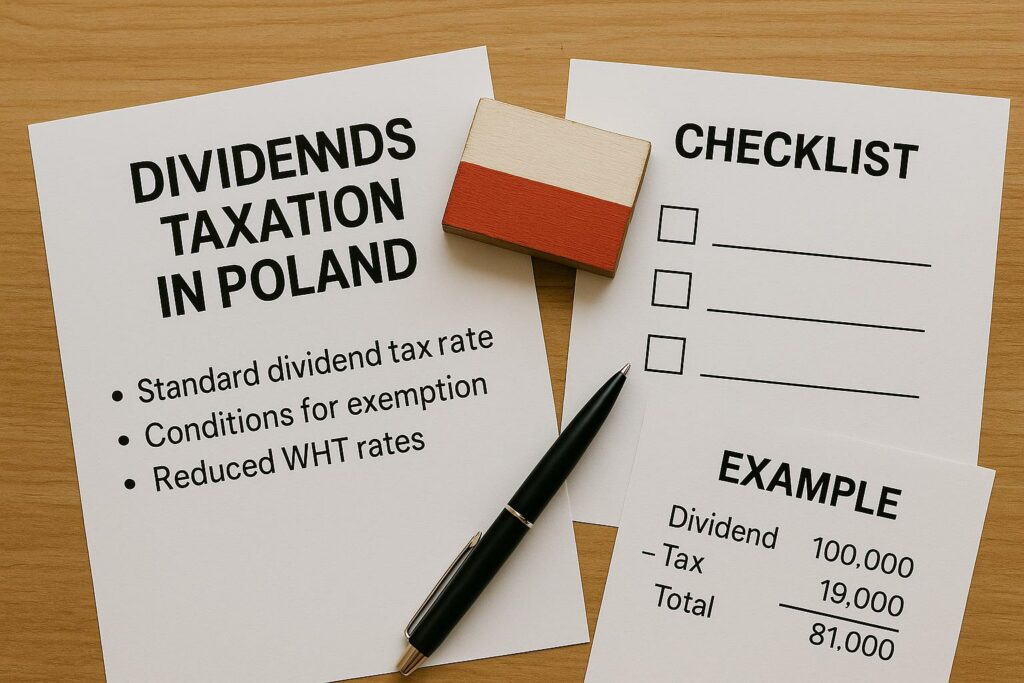

This guide explains how dividends are taxed in Poland: the standard dividend tax rate of 19%, conditions for dividend tax exemption for EU/EEA/Swiss companies, reduced withholding tax (WHT) rates under a double tax treaty, and the company’s obligations as tax remitter. It includes examples and a step‑by‑step checklist for a company paying the dividend.

What is a dividend and who pays the tax

A dividend is a distribution of a company’s profit to shareholders. Under Polish tax law, the recipient of the dividend is the taxpayer for income tax purposes, while the company paying the dividend acts as tax remitter and withholds withholding tax (WHT) on payment. The recipient gets the net amount and the remitter pays WHT to the Polish tax office.

In this system, the company acts as a tax remitter. This means your company is legally obligated to:

- Calculate the correct amount of tax due.

- Withhold the tax from the gross dividend amount.

- Remit (pay) the tax to the appropriate tax office account.

The shareholder receives the net amount, after the tax has already been paid on their behalf.

Standard dividend tax rate in Poland – 19%

The standard rate (standard dividend tax rate) is 19% and generally applies to:

- individuals (subject to the Personal Income Tax Act – PIT).), and

- companies (subject to the Corporate Income Tax Act – CIT).

Dividends are treated as capital gains / investment income and are subject to WHT at payment. This is a separate dividend tax and, for Polish tax residents, it usually does not merge with other taxable income in the annual return if WHT was correctly withheld by the remitter.

WHT exemption for EU/EEA/Swiss corporate shareholders

Poland’s implementation of the Parent‑Subsidiary Directive in the Corporate Income Tax Act allows a tax exemption on dividend payment between companies if all of the below are met:

- Recipient status: the company receiving the dividend is subject to income tax on its worldwide income in an EU/EEA state, the Republic of Poland, or Switzerland.

- Shareholding threshold: at least 10% of the payer’s capital (25% for a Swiss recipient).

- Holding period: an uninterrupted period of 2 years (may elapse after the payment date).

- Documentation: a valid certificate of tax residence and required statements for Polish tax authorities.

Effect: exemption from income tax in Poland, so no WHT. If the conditions are not met, apply the standard rate 19% or reduced withholding tax rates under a treaty.

Double tax treaties: reduced rate on dividend income

For payments to non‑residents, check the relevant double tax treaty (agreement concluded by Poland). Typical withholding tax rate brackets are 5%, 10%, or 15%, depending on the treaty and any ownership thresholds.

Formal condition: before applying a reduced rate, the payer must obtain the payee’s tax residence certificate. Without it, the payer must withhold 19%. Tax may be deducted or credited in the recipient’s country of tax residence under the treaty.

How and when to pay the tax: step‑by‑step? A Practical Guide

- Shareholders’ resolution to distribute profit and make the dividend payment.

- Calculate WHT on the gross dividend using the correct tax rate: 19%, a reduced rate under a treaty, or tax exemption.

- Withhold and pay: the remitter pays WHT to the competent tax office by the 20th day of the month following the month of payment (tax due deadline).

- Year‑end filings:

- PIT‑8AR for individuals, and

- CIT‑6R for corporate recipients.

Filing deadline: end of January following the tax year.

Practical note: in‑kind dividends are also subject to WHT. The tax base is the fair market value on the payment date. The company needs cash to pay the tax.

Worked examples: dividends in Poland

Example 1: Polish tax resident individual

Scenario: A Polish limited liability company, “ALPHA Sp. z o.o.”, passes a resolution to pay a dividend of PLN 50,000 to a shareholder, Mr. Jan Nowak, who is a Polish tax resident.

| Gross Dividend: | PLN 50,000 |

| Applicable Tax Rate: | 19% |

| Tax Calculation: | PLN 50,000 * 19% = PLN 9,500 |

| Net Dividend for Shareholder: | PLN 50,000 – PLN 9,500 = PLN 40,500 |

Company’s Obligations: ALPHA Sp. z o.o. must pay PLN 9,500 to the tax office and PLN 40,500 to Mr. Nowak. Mr. Nowak does not need to report this income in his personal annual tax return.

Effect: The taxpayer typically does not report this income in the annual tax return if tax was withheld correctly by the company paying the dividend.

Example 2: Foreign corporate shareholder – PSD exemption

Scenario: “COMPANY PL Sp. z o.o.” is paying a dividend of EUR 200,000 to its parent company, “COMPANY DE GmbH,” based in Germany. DE GmbH has held 100% of the shares for five years.

- Analysis: All conditions for the CIT exemption under the Parent-Subsidiary Directive are met (EU recipient, >10% stake, >2 year holding period).

- Action: POLSKA Sp. z o.o. must obtain a valid certificate of tax residence from DE GmbH.

- Result: With the certificate – WHT exemption in Poland. POLSKA Sp. z o.o. can apply the exemption and pay the full EUR 200,000 to DE GmbH without withholding any tax (WHT exemption). It will report this exempt dividend in its annual CIT-6R declaration. The payment is shown as exempt from tax in CIT‑6R. If it failed to obtain the certificate, it would have to withhold tax on dividends according to the Poland-Germany DTT (typically 5%).

Summary: Key Takeaways for Your Business

- 19% is the Default: The standard dividend tax rate in Poland is 19%.

- You Are the Remitter: Your company is legally responsible for calculating, withholding, and paying the tax on time.

- Check for Exemptions: For dividends paid to corporate shareholders within the EU/EEA, verify if the conditions for a full tax exemption are met.

- Documentation is Crucial: Always secure a valid certificate of tax residence from foreign shareholders to apply lower DTT rates or exemptions. Failure to do so forces you to use the 19% rate.

- Mind the Deadlines: Pay the withheld tax by the 20th of the following month and file annual declarations (PIT-8AR, CIT-6R) by the end of January.

If you need more information on tax treatment for a planned dividend or help verifying the WHT rate on the dividend, contact our team.

FAQ

As a shareholder, do I need to report the dividend I received in my annual tax return?

If you are a Polish tax resident and the dividend was paid by a Polish company that correctly withheld the tax, you do not need to report this income in your annual PIT return. The tax is considered final and is fully settled by the remitter (the paying company).

What is a certificate of tax residence and why is it so important?

A certificate of tax residence is an official document issued by a foreign tax authority that confirms where a person or company is resident for tax purposes. For a Polish company paying a dividend, this certificate is the essential proof required to apply a reduced tax rate under a Double Taxation Treaty or to use a tax exemption. Without it, you are legally obligated to withhold the standard rate 19% Polish tax.

What happens if a dividend is paid in-kind (e.g., company assets) instead of cash?

In-kind dividends are also subject to tax. The tax base is the market value of the transferred asset on the date of the payment. This creates a practical challenge for the paying company, as it must remit the tax in cash, even though no cash was distributed. This situation requires careful financial planning to ensure liquidity for the tax payment in cash.

Sources

- Act of 26 July 1991 on Personal Income Tax (Journal of Laws of 2024, item 226, as amended).

- Act of 15 February 1992 on Corporate Income Tax (Journal of Laws of 2023, item 2805, as amended).*

- Council Directive 2011/96/EU of 30 November 2011 on the common system of taxation applicable in the case of parent companies and subsidiaries of different Member States.