On this page, you will find a complete explanation of how distance sales within the EU work after the 1 July 2021 VAT reform. You will learn:

- what distance selling means under EU law,

- what the €10,000 threshold is and how it affects VAT obligations,

- how the OSS (One Stop Shop) and IOSS (Import One Stop Shop) systems simplify VAT reporting,

- when local VAT registration is still required,

- which goods are excluded (e.g. excise products),

- practical steps for e-commerce businesses to stay compliant.

What is distance sale i.e. intra-Community distance sales of goods?

Intra-Community distance sale of goods means the supply of goods to private consumers (B2C) in another EU member state, where the transport is arranged by the seller or on their behalf. In practice, it includes online sales and mail orders – typical e-commerce models when goods are shipped from one EU country to another. Such transactions are subject to VAT in the consumer’s country, with certain exceptions.

Reform since 1 July 2021 – new EU VAT rules

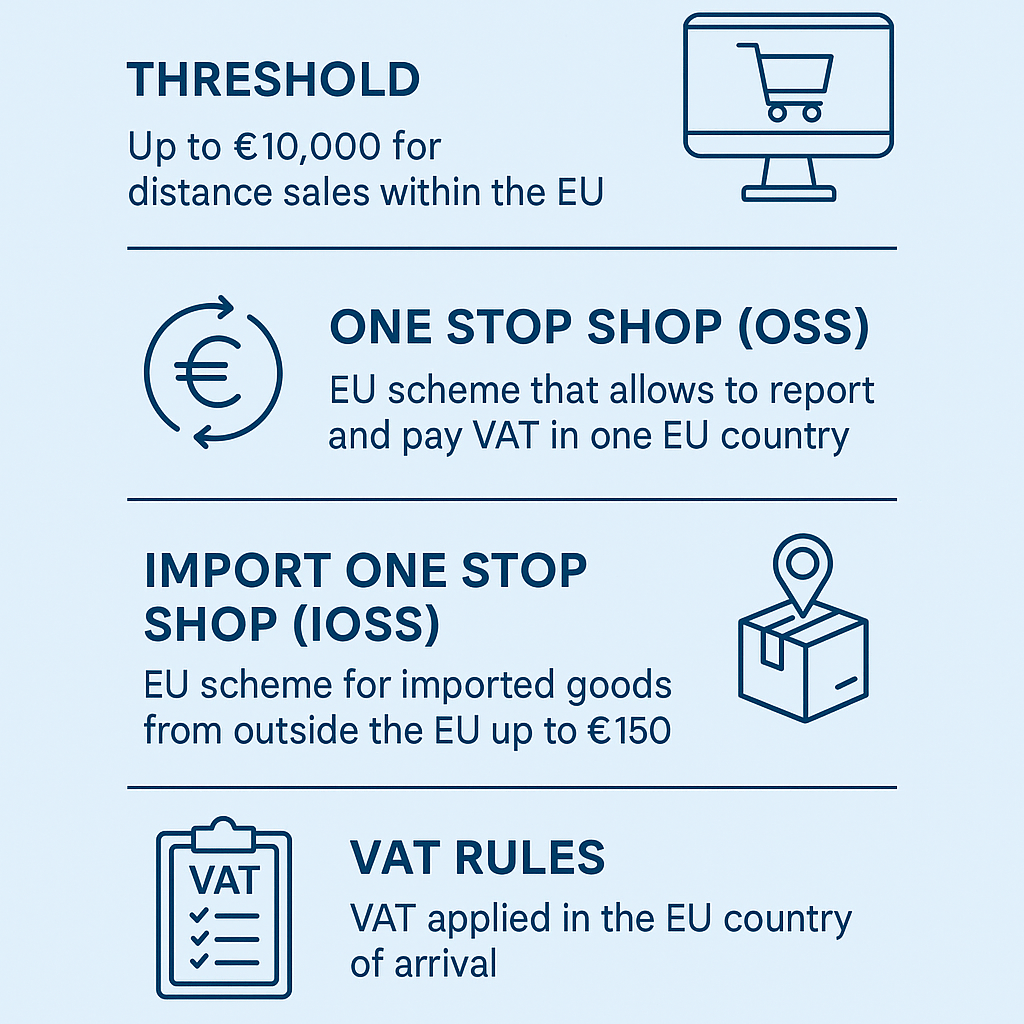

On 1 July 2021, the European Commission introduced new VAT regulations across the European Union. National thresholds were abolished and replaced with a single EU-wide threshold of EUR 10,000 (net annual turnover for B2C distance sales + certain digital services). Once this threshold is exceeded, the place of supply is the country of destination (the consumer’s state), and the seller must apply the relevant VAT rate there.

Thresholds for distance sales

- Up to EUR 10,000 per year – you may pay VAT in your home country (the dispatching country), unless you voluntarily opt to tax in the customer’s country.

- Above EUR 10,000 – the VAT liability shifts to the EU country of destination. You can either register for local VAT in that country or use the One Stop Shop (OSS) system.

VAT One Stop Shop (OSS) – simplified reporting

The VAT OSS allows sellers to declare and pay VAT due on intra-Community distance sales within the EU via a single registration in their home country (e.g. under the local Value Added Tax Act). A quarterly VAT return is filed in OSS, and the tax authority forwards the amounts to each relevant country. OSS applies to intra-Community distance sales of goods (B2C), but does not cover goods subject to excise duties (alcohol, tobacco, fuel) – in such cases, local VAT registration remains necessary.

Import One Stop Shop (IOSS) – for goods from third countries

If you sell goods imported from third territories or third countries (e.g. UK, USA, China) directly to EU consumers, and the intrinsic value of the consignment does not exceed EUR 150, you may use the IOSS scheme. This simplifies VAT and customs by collecting import VAT at the checkout. For consignments above EUR 150, standard import procedures apply.

When OSS/IOSS vs. local registration?

- OSS – when you exceed the EUR 10,000 threshold for distance sales within the EU.

- IOSS – when you make distance sales of imported goods up to EUR 150.

- Local VAT registration – required for goods subject to excise duties, for storing goods in local warehouses, for B2B sales, or when you choose to register locally instead of OSS.

Key obligations for distance sellers

- Identify the correct place of supply (country where the goods are delivered).

- Apply the proper local VAT rate once the threshold is exceeded.

- Ensure transparent invoicing and checkout process (VAT included, correct VAT rate).

- Submit VAT returns (quarterly via OSS/IOSS or locally as required).

- Monitor whether goods are subject to excise and if special rules apply.

Example – Polish e-shop selling to France (B2C)

A Polish online store dispatches goods to French private customers. Once the total cross-border B2C turnover exceeds EUR 10,000, sales must be taxed with French VAT. Instead of registering for VAT in France, the seller can register for VAT OSS in Poland and declare French VAT rates via the OSS return.

Practical steps for compliance

- Calculate total B2C turnover to other EU countries.

- Decide whether to register locally or use OSS (recommended for multi-country sales).

- Adjust systems for correct local VAT rates and invoicing.

- Implement IOSS for low-value consignments from third countries.

- Plan and submit VAT returns on time.

- Keep updated with changes in EU VAT regulations.

FAQ

Is the EUR 10,000 threshold per country?

No. It is a common threshold for all cross-border B2C sales within the EU.

Can I apply foreign VAT rates even below the threshold?

Yes. You may voluntarily opt for OSS and charge destination VAT from the start.

Does OSS apply to B2B transactions?

No. OSS covers B2C distance sales only. B2B is usually treated as intra-community supply/acquisition.

What about excise goods?

Goods subject to excise duties (alcohol, tobacco, fuel) are excluded from OSS/IOSS and generally require local VAT registration.

More information can be found here : https://taxationcustoms.ec.europa.eu/taxation/vat/vat-directive/place-taxation_en

Need Help with VAT OSS or IOSS?

Navigating EU VAT rules for distance sales can be complex – from registration to filing VAT returns. INTERTAX team specializes in:

- VAT OSS registration

- Preparation and submission of VAT returns

- Advisory on local VAT registration and compliance

- Support with EU distance selling rules and threshold monitoring

Contact us today to ensure your distance selling business remains compliant and efficient across all EU countries.